Finance Bill 2023

Finance Minister's Speech

BUDGET 2022-2023 AT A GLANCE

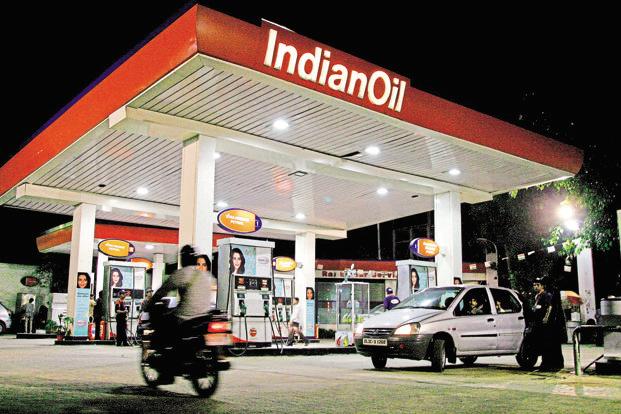

Oil prices rise more than half a percent for 3rd straight day

Oil prices rise more than half a percent for 3rd straight day

NEW DELHI:MMNN: 07 Feb 2024

Oil prices rose more than half a percent for the third straight day. In intra-day trade, Brent crude was trading 0.60 percent higher at 79 dollars and six cent per barrel, while U.S. West Texas Intermediate crude was also trading up 0.64 percent at 73 dollars and 78 cents per barrel when reports last came in.

Gold Trades at ₹62,330 per 10 Grams, Silver at ₹70,360 per Kilogram in Indian Markets

Gold Trades at ₹62,330 per 10 Grams, Silver at ₹70,360 per Kilogram in Indian Markets

NEW DELHI:MMNN: 06 Feb 2024

Today, gold was trading higher at the Multi Commodity Exchange for April contracts. The precious metal was up 10 rupees to trade at 62,330 rupees per ten gram. Silver futures for March contracts were down 120 rupees to trade at 70,360 rupees per kilogram when reports last came in.

In the global markets, gold was trading down at 2,042 dollars and 50 cents per ounce at COMEX. Silver was trading down at 22 dollars and 40 cents per ounce in the intra-day trade when reports last came in.

FSDC meeting discusses global financial turmoil and India's economic stability

FSDC meeting discusses global financial turmoil and India's economic stability

NEW DELHI:MMNN: 12 may 2023

Finance Minister Nirmala Sitharaman chaired the 27th Meeting of the Financial Stability and Development Council (FSDC) on 8th May 2023. This was the first meeting of the FSDC after the announcement of the Budget 2023-24. The FSDC is the apex body of sectoral regulators, headed by the Union Finance Minister. In the program Spotlight of Akashvani, AK Bhattacharya, Economic Analyst discussed the agenda and significance of the meeting.

The meeting was aimed at taking stock of the threats, challenges, and opportunities for India's financial sector and ensuring that it remains stable amidst the global turmoil. The Economic Analyst pointed out that in today's interconnected world, it is impossible to insulate any sector of the economy from global headwinds or tailwinds, especially in the financial sector. Hence, it is crucial to recognize this interconnectedness and put necessary safeguards in place so that the Indian financial sector can withstand any shocks without causing any undue harm to customers, investors, or shareholders.

Oil prices slide 1% as US inventory levels surge

Oil prices slide 1% as US inventory levels surge

NEW DELHI:MMNN: 10 may 2023

Oil prices on Wednesday fell around one percent ending a three-day rally as an unexpected rise in U.S. oil inventories sparked demand concerns. Investors also awaited inflation data for cues on U.S. interest rates.

In intra-day trade, Brent crude was trading at 76 dollars and 80 cents per barrel while West Texas Intermediate crude price was at 73 dollars per barrel when reports last came in.

India's economic success hailed at Asian Development Bank meet in South Korea

India's economic success hailed at Asian Development Bank meet in South Korea

NEW DELHI:MMNN: 9 may 2023

India's economic success hailed at Asian Development Bank meet in South Korea

Finance Minister Nirmala Sitharaman led the Indian delegation to the 56th Annual General Meeting of the Board of Governors of Asian Development Bank (ADB) in South Korea. Economic analyst ShankkarAiyer and Akashvani correspondent Rajesh Lekh participated in a discussion on the event in the program Spotlight.

According to Aiyer, the center of gravity of economic growth has shifted to the Indian Ocean region, where India is in pole position as the fifth largest economy in the world and soon to be the fourth. The Finance Minister's visit showcased India's potential as the fastest-growing large and raised issues such as climate change and innovative financing for climate finance.

ADB's objective is to envision a prosperous, inclusive, resilient and sustainable Asia and the Pacific, while eradicating extreme poverty in the region. The Finance Minister's interactions with global economists, governors, and finance ministers of ADB member countries were centered on the reconfiguration of the supply chain post-pandemic and poverty alleviation.

India's success in creating a digital and physical infrastructure that contributes singularly and cumulatively to poverty alleviation has been repeatedly mentioned at the Fund Bank Meetings and ADB Meetings, according to Aiyer. The world has lauded the Aadhar identity platform, which creates inclusive accounts with the Jandhan, Aadhar, and Mobile trinity, and the success of the National Payments Corporation and UPI. At least seven or eight countries have shown interest in creating a similar identity platform.

The Economic analyst pointed out that in the post-pandemic world, the supply chain story has moved from just-in-time supply chain to just-in-case supply chain. India has become part of the solution to a resilient global supply chain which gives a potential to GDP growth, trade and a better current account deficit.

Hence, the annual meeting of ADB is an occasion for India to present its point of view on geopolitics, climate change, and financing, and to represent Global South. With the meeting, the Finance Minister has showcased India's rise and potential at the global stage.

RBI, BIS launch global technology competition ‘G20 TechSprint’

RBI, BIS launch global technology competition ‘G20 TechSprint’

NEW DELHI:MMNN: 5 may 2023

Reserve Bank of India(RBI) and Bank for International Settlements (BIS) have launched G20 TechSprint, a global technology competition. RBI and the BIS Innovation Hub have jointly announced the fourth edition of the G20 TechSprint. RBI said that the 2023 TechSprint will focus on developing innovative technology solutions for cross-border payments. The competition is open for developers around the world for submitting application from today to 4th June. The results will be announced at a final event in August or September this year.

Shortlisted teams will be invited to develop their solutions over a six-week period and each team will be eligible for a stipend of eight lakh rupees approximately 10,000 US dollar. An independent panel of experts will select the most promising solution to each problem statement from the shortlisted solutions. The winners for each problem statement will receive an award of forty lakh rupees approximately 50,000 US dollar.

Ethanol sector growth has been tremendous which set sort of example for world: Piyush Goyal

Ethanol sector growth has been tremendous which set sort of example for world: Piyush Goyal

NEW DELHI:MMNN: 3 may 2023

Union Minister of Commerce and Industry Piyush Goyal has said that the growth of the ethanol sector has been tremendous which has set a sort of example for the world. Addressing a National Seminar on 'Maize to Ethanol’ in New Delhi, he said that in the last 9 years, the sugar sector has been self-sufficient with more than 99.9 per cent payment to farmers for the previous season.

He added that now, ethanol will support maize farmers in increasing their income and bringing growth with stability on the lines of sugarcane farmers. The Minister said that investment of thousands of crores have come creating thousands of jobs in the rural sector which has generated a multiplier effect on the Indian economy. Mr. Goyal highlighted that environment friendly fuel like ethanol has been on the top priority list of Prime Minister Narendra Modi.

He said, it has resulted in more than doubling of ethanol blending in just 2 years and the target of 20 per cent ethanol blending has also been preponed from 2030 to 2025. The Minister said that timely planning, industry friendly policies and transparent approach of the Union Government with collaboration of industry has made these achievements a reality.

Finance Minister Nirmala Sitharaman directs CBIC to implement action plan to increase taxpayer base through enhanced use of technology

Finance Minister Nirmala Sitharaman directs CBIC to implement action plan to increase taxpayer base through enhanced use of technology

NEW DELHI:MMNN: 29 April 2023

Finance Minister Nirmala Sitharaman has directed the Central Board of Indirect Taxes and Customs (CBIC) to implement an action plan to increase the taxpayer base through enhanced use of technology. Ms Sitharaman said this while chairing a review meeting with CBIC in New Delhi today. She also directed CBIC to introduce its automated GST return scrutiny by next week.

During the meeting, the Finance Minister was briefed on the final revenue achievement in total Indirect Tax collections for 2022-23. It stood at Rs 13 lakh 82 thousand crore, as against Rs 12 lakh 89 thousand crore in 2021-22. On the GST side, the average gross monthly collection for the year 2022-23 stood at Rs one lakh 51 thousand crore. The monthly GST revenue collections exceeded Rs one lakh 40 thousand crore for 12 months in a row. The comprehensive review covered a variety of work areas including trade facilitation, taxpayer services, grievance redressal of the trade, finalisation of disciplinary cases and infrastructure projects.

Ms Sitharaman emphasised the need for continuously improving taxpayer services. In order to intensify its drive against fake billing and Input Tax Credit, the Minister asked CBIC to undertake a comprehensive root cause analysis by studying the typology of cases already booked. She asked them to come up with recommendations on technology-based solutions to address the menace and prevent its occurrence.

Reliance joins hands with Warner Brothers and HBO: Soon you will be able to watch great series like Game of Thrones and Harry Potter on Jio Cinema

Reliance joins hands with Warner Brothers and HBO: Soon you will be able to watch great series like Game of Thrones and Harry Potter on Jio Cinema

NEW DELHI:MMNN: 27 April 2023

Movies and shows like Game of Thrones, Harry Potter, Succession and Discovery will soon be available on the Jio Cinema app. For this, Mukesh Ambani's company Viacom18 has a deal with Hollywood's well-known production house Warner Bros Discovery Inc. After this deal, Jio Cinema will give direct competition to Amazon Prime Video and Disney Hotstar.

Viacom18 and Warner Bros said, movies and shows on Jio Cinema will premiere in the US only. Previously, Disney had the rights to stream content from Warner Bros. and HBO. This partnership ended on 31 March 23. For this reason Indian viewers were not able to stream shows like HBO's Game of Thrones. Warner Bros. is the parent company of HBO.

Warner Bros' content will be available only on Jio Cinema

News agency Reuters wrote quoting sources that this partnership will be exclusive. That is, Warner Bros. shows and movies will not be able to offer most of their popular movies and series to other Indian OTT platforms including Amazon Prime Video and Disney Hotstar.

Farzad Palia, Head - Subscription Video-on-Demand and International Business, Viacom18, said, "Jio Cinema has become the largest platform for live sports. We are now on a mission to make Jio Cinema the most magnetic destination for entertainment.

Jio is showing IPL for free

This time live streaming of IPL is happening for free in 4K quality. Jio Cinema is the official live-streaming partner of IPL 2023. Earlier, IPL was shown on Disney Hotstar. In such a situation, Hotstar subscription had to be taken to watch it. Right now you do not have to pay any fee to watch anything on Jio Cinema.

Subscription will have to be taken on Jio Cinema,

in an interview given to Bloomberg in the past, Reliance's Media and Content Business President Jyoti Deshpande had said that there is a plan to release more than 100 movies and web series on Jio Cinema. New content will be released before the end of IPL 2023.

Jio Cinema will start charging for original content. Although Jyoti Deshpande told that the company has not yet finalized the Jio Cinema plan, the price will be decided soon. Deshpande had said that the current OTT platform is dominated by foreign content.

5.5 billion unique views in Jio Cinema

Jio Cinema has claimed that the platform has received 5.5 billion unique video views in the first week of IPL. And on April 12, 2023, a record 22 million people watched the Chennai Super Kings vs Rajasthan Royals match in Jio Cinema. Let us tell you that IPL has started from March 31, whose last match will be played in Bengaluru on May 21.

PM Svanidhi's scheme gives small loans to needy people without CIBIL score: MoS Finance Bhagwat Karad

PM Svanidhi's scheme gives small loans to needy people without CIBIL score: MoS Finance Bhagwat Karad

NEW DELHI:MMNN: 24 April 2023

Union Minister of State for Finance Dr. Bhagwat Karad today asked bankers to focus on banking the unbanked, securing the unsecured, and funding the unfunded. He was speaking at a review meeting on the Financial Inclusion Parameters of Western Maharashtra in Satara today.

The Minister further said that PM Svanidhi's scheme gives small loans to needy people without the condition of collateral or a CIBIL score. The Minister also exhorted bankers to increase banking penetration in rural areas. He directed banks to reduce the waiting period for loan disbursement. The Minister added that even a developed State like Maharashtra has scope for increasing the number of bank branches in rural areas.

Shri Karad further stated that the banking sector is a big pillar in the target towards becoming a five trillion economy. The Minister further added that new customers should be incorporated into the banking sector by opening their bank accounts, and special camps should be arranged for the same. He suggested imbibing a competitive spirit in the banking sector for the development of all. The Minister on this occasion appreciated the all round performance achieved by Kolhapur District on Financial inclusion parameters.

Apple's store in Delhi after Mumbai, know who will benefit and who will be harmed

Apple's store in Delhi after Mumbai, know who will benefit and who will be harmed

NEW DELHI:MMNN: 20 April 2023

After Mumbai, the world's leading tech company Apple, which manufactures iPhone, is now going to open its store in Delhi as well. iPhone and other Apple products are already being sold in the country. But tremendous enthusiasm is being seen in the country regarding Apple's stores. The question arises that what is going to be the benefit of opening Apple's store? The reason for this is that the way Apple has changed the retail business in the world, its example is rarely seen. The company opened its first retail stores in 2001 in California and Virginia. To reduce dependence on other retailers and better showcase its products, the company decided to open its own stores. Now it has become a status symbol in a way. Apple has 272 stores in the US alone.

Today Apple's stores are in more than 20 countries of the world. After America, it has the maximum number of 45 stores in China. There are 39 stores in the UK, 28 in Canada, 22 in Australia, 20 in France, 17 in Italy and 16 in Germany. Apple is the largest company in the world by market cap. The biggest feature of Apple's store is its design. Apple has a unique way of displaying products in its stores. Also, users get a different experience in this. Huge crowds are seen outside Apple stores during the launch of new products in the US and Europe. Apple's store in Mumbai is inspired by Kaali Peeli Taxi

what will be the benefit

All employees at Apple Stores have a mobile POS. This makes it easy to sell products. That is, you do not need to stand at the bill counter. You can make payment at the counter where you are checking the product. The biggest advantage of buying products from the Apple Store is that you get exclusive deals and offers there. For example, if you are a student, you can get the benefit of back to university offer. In the US, the company gives a gift card of $ 150 under this. Not only this, if you buy a product from Apple's store, then you can give it a personal touch according to your own.

Till now the company used to sell its products through exclusive Apple premium partner stores, major retailers and trade and e-commerce platforms. The company says that the new retail locations will expand its business in India. With these stores, the company's customers in India will be able to explore new products. It is believed that in its stores, the company will also set up experience centers for the customers. This will cause some loss to the retailers. Retailers are apprehensive that with the opening of Apple stores in Mumbai and Delhi, the number of their customers may decline by 50 to 60 percent.

who will be harmed

Mumbai and Delhi account for 20 per cent of the total annual sales of iPhones in India. Some say that Apple will first release the stock for its stores. This may harm the rest of the retailers. However, sources in the company have dismissed this apprehension. He says that the entire retail ecosystem will benefit from the opening of Apple's retail stores. Navneet Pathak, general secretary of All India Mobile Retailers Association, said that the company would like to create similar hype in Delhi and Mumbai during the new launch. Existing Apple customers may want to visit these stores before purchasing a new product. Although some people do not give it much preference. He says that 80 percent of Apple's new customers come from small towns. In such a situation, two Apple stores are not going to make much difference.

Young Indians-YEA Summit 20 April to

MMNN: 18 April 2023

Bhopal/Business:Young Indians, a wing of the Confederation of Indian Industries, will host the summit organized by the G20 Young Entrepreneurs Alliance (YEA). This conference, organized in collaboration with the Ministry of Sports and Youth Affairs, will be held on April 20 at the auditorium of LNCT Group, Raisen Road. Mayor Mrs. Malti Rai will be the chief guest and speaker of this program. Deputy Collector, Bhopal Nidhi Choksey; Shivendra Agarwal, President, Young Indians, Bhopal Chapter; Vice President Poojashree Choukse; National Youth Vice President Anuj Garg; Former President Anjali Goyal; and Bhakti Sharma, National Executive Member of Bharatiya Janata Yuva Morcha; And Shantanu Saxena, Managing Director of Magna Peritus Law Firm, will express his views in the panel discussion organized during this period. Shivendra Agarwal, President of Young Indians, Bhopal Chapter, said in a press release that the theme of the convention was ' 'Samvad' has been held between Young Indian Achievers and Heads of Urban and Rural Government Institutions. He also pointed out that the G20 YEA seeks to promote youth entrepreneurship as a powerful driver of economic renewal, job creation, innovation and social change. Each year, the G20 YEA brings together hundreds of the world's top young entrepreneurs to share their ideas with leading business and political leaders to catalyze global change.

Google CEO Sundar Pichai hints at more layoffs, wants to ensure efficiency

Google CEO Sundar Pichai hints at more layoffs, wants to ensure efficiency

NEW DELHI:MMNN:13 April 2023

New Dehli: Google CEO, Sundar Pichai, has hinted at another round of layoffs at Google. In January this year, Google decided to fire six per cent of its workforce, leaving 12,000 Googlers without a job.

Sundar Pichai was speaking with the Wall Street Journal when he hinted towards more layoffs. However, he did not directly address the subject.

He also discussed Google's work in the artificial intelligence (AI) domain. He said that Google's chatbot Bard was being integrated into products like Gmail and Google Docs to increase efficiency.

He said, "We're very, very focused on this set of opportunities we have, and I think there's a lot of work left. There's also an important inflection point with AI. Where we can, we are definitely prioritizing and moving people to our most important areas, so that is ongoing work."

Sundar Pichai said they were looking into every aspect of Google's work and taking steps to re-engineer its cost base permanently. He said that Google aims to increase its efficiency by 20 per cent. He stressed that Google needs to build upon the improvements it has made in recent times.

He added that job cuts were made after careful consideration. He said, "We've decided to reduce our workforce by approximately 12,000 roles. We've already sent a separate email to employees in the US who are affected. In other countries, this process will take longer due to local laws and practices."

This is a better chance to increase trade with Russia: Minister Shri Sakhalecha

MMNN: 5 April 2023

Business:MSME Minister Shri Omprakash Sakhalecha has said that the establishment of the Chamber of Commerce and Industry of the Russian Federation in India will give a boost to the country's international cooperation, partnership and business development. India has long standing relations with Russia and now there is a need to increase trade with these relations. Minister Shri Sakhalecha was addressing the inauguration ceremony of the Chamber of Commerce and Industry of the Russian Federation at the India Habitat Center in Delhi on Tuesday.

Minister Mr. Sakhalecha said that CCI India being launched under the chairmanship of Mr. Igor Pyasetsky, India head of CCI Russian Federation, aims to establish long-term cooperation between India and Russia through creation of new environment as well as support domestic companies Is. Shri Sakhalecha said that a new environment has been created in the country for MSMEs under the leadership of Prime Minister Shri Narendra Modi. Shri Sakhalecha highlighted the policies of MSME and Science and Technology Department in Madhya Pradesh under the leadership of Chief Minister Shri Shivraj Singh Chouhan and invited business representatives of Russian Federation to invest in Madhya Pradesh.

Minister Shri Sakhalecha said that their manufacturing units with Russian supply chain are entering the Indian markets, which is a golden opportunity for the entrepreneurs of both the countries. CCI of Russian Federation will act as a bridge between India and Russia to solve the problems of entrepreneurs and for their sustainable development.

At the event, the President of CCI of the Russian Federation said that there are about 350 entrepreneurs working in India looking for business opportunities in metallurgy and machinery, defense and agro processing. He said that 20 companies of Russian Federation are ready for cooperation/MoU. The inaugural ceremony was attended by Mr. Sergey Kataryin, President, CCI Russian Federation, India Head, CCI Russian Federation, Mr. Igor Piasetsky, Secretary, Embassy of Russia, Mr. Ildar, Ex-Chief Minister of Goa, Mr. Digambar Kamat, Mr. Panna Lal Bhansali of Seva Bharati, representatives from different states of Russia Representatives of MSME and Science and Technology Department of the Government of Madhya Pradesh were present along with the representatives of M.P.

Nita Mukesh Ambani Cultural Centre to open doors to audience on March 31

:MMNN: March 31 2023

A multi-disciplinary cultural space, India's first-of-its-kind, the Nita Mukesh Ambani Cultural Centre, will open on March 31 with an exquisite showcase of the best of India across music, theatre, fine arts and crafts to audiences from India and the world.

The launch will feature a specially curated art and craft exposition called 'Swadesh' along with three blockbuster shows - a musical theatrical called 'The Great Indian Musical: Civilization to Nation' a costume art exhibition called 'India in Fashion' and a visual art show called 'Sangam/Confluence'.

Together these will present the diversity of India's cultural traditions and their impact on the world while also showcasing the diversity of spaces at the cultural centre.

Speaking on the eve of the inaugural day, Nita Ambani said, 'Bringing this cultural centre to life has been a sacred journey. We were keen to create a space for both promoting and celebrating our artistic and cultural heritage in cinema and music, dance and drama, literature and folklore, arts and crafts and science and spirituality. A space where we showcase the best of India to the world and welcome the best of the world to India.'

The centre will offer free access for children, students, senior citizens and the differently-abled. It will focus on community nurturing programmes, including school and college outreach and competitions, awards for art teachers, in-residency programmes and art literacy programmes among others.

'The Great Indian Musical: Civilization to Nation' will see a line-up of exceptional Indian talent, along with a Tony & Emmy award-winning crew, and has been conceived and directed by Feroz Abbas Khan. The marquee production will bring together talents such as Ajay-Atul (music), Mayuri Upadhya, Vaibhavi Merchant, (choreography) along with 350+ artists, including an epic 55-piece live orchestra from Budapest, to showcase India's cultural journey through history. The visual spectacle will also feature over 1,100 costumes designed by leading fashion designer Manish Malhotra.

The cultural centre, located within the Jio World Centre at Bandra Kurla Complex, is home to three performing arts spaces: the 2,000-seat Grand Theatre, the technologically advanced 250-seat Studio Theatre, and the dynamic 125-seat Cube.

It also features the Art House, a four-storey dedicated visual arts space built as per global museum standards with the aim of housing a shifting array of exhibits and installations from the finest artistic talent across India and the world.

Spread across the centre's concourses is a captivating mix of public art by renowned Indian and global artists, including 'Kamal Kunj' - one of the largest Pichwai paintings in India.

Micro, small and medium scale industrial units are the soul of the state's economy: Chief Minister Shri Chouhan

MMNN: 29 March 2023

Business:Chief Minister Shri Shivraj Singh Chouhan has said that micro, small and medium scale industrial units are the soul of Madhya Pradesh's economy. These units create employment opportunities for the youth along with value addition of agricultural products and other materials at the local level. These units have an important role in boosting the economy. Entrepreneurs are our development partners. The state government gives top priority to micro, small and medium scale units. We want to spread a network of these units in the state. Every possible effort will be made to remove the difficulties coming in this direction.

Chief Minister Shri Chouhan was addressing 1450 MSME industrial units by transferring subsidy of Rs 400 crore with a single click. Micro, Small and Medium Enterprises Minister Mr. Omprakash Sakhalecha, Secretary Mr. P. Narhari and other officials were present in the program held at the Chief Minister's residence office building Samvat. Entrepreneurs from all the districts of the state, representatives of industry organizations participated virtually in the programme. The Chief Minister also interacted virtually with representatives of industry organizations and entrepreneurs.

Madhya Pradesh, India's fastest growing economy

Chief Minister Shri Chouhan said that India's economy is progressing under the leadership of Prime Minister Shri Narendra Modi. Activities are being carried out by developing a road map for self-reliant Madhya Pradesh, in line with the Prime Minister's resolve to build a self-reliant India. Madhya Pradesh is the fastest growing economy of India. The GSDP of the state has become 13 lakh crore. But the capita income is one lakh 40 thousand rupees. We have also increased the irrigation capacity a lot. Agriculture is the backbone of our economy. A large number of employment opportunities are being created for the youth by skill upgradation in value addition of agricultural products.

Our top priority is to remove the difficulties of entrepreneurs

Chief Minister Shri Chouhan said that the state government is providing all possible cooperation to develop successful entrepreneurs from the land of Madhya Pradesh. Cluster approach has an important role in removing the difficulties of the entrepreneurs. The state government is also making efforts in the direction of providing built infrastructure to small industries. The subsidy given to the entrepreneurs should be made available to them without any difficulty and the subsidy has been given only with the aim of zeroing down the possibilities of transactions taking place in it. Chief Minister Shri Chouhan said that under the Mukhyamantri Yuva Kaushal Earning Scheme, a stipend of Rs. Upgradation of skills by learning work will increase the chances of youth getting employment.

Chief Minister Shri Chouhan discussed with entrepreneurs

State President of Laghu Udyog Bharti Mr. Mahesh Gupta, President of Mandideep Industrial Association Dr. Rajeev Aggarwal, Gwalior's entrepreneur Mrs. Anju Bhadoria and Shahdol's Rice Mill Director Mr. Navneet Singhania interacted virtually with Chief Minister Mr. Chouhan. Mr. Mahesh Gupta suggested providing support from the state for land, infrastructure and machinery in the cluster system. Dr. Rajeev Aggarwal said that due to the implementation of MSME policy and startup policy in the state, entrepreneurs from other states are coming to Madhya Pradesh to set up their units. Mrs. Anju Bhadoria requested to set up a special incentive system for women entrepreneurs. Mr. Navneet Singhania said that only with the cooperation and encouragement of the officers, he has been able to establish and run the industrial unit successfully.

Getting subsidy in the last days of the financial year is like a lifeline for entrepreneurs

Micro, Small and Medium Enterprises Minister Mr. Omprakash Sakhalecha said that under the leadership of Chief Minister Mr. Chouhan, industrial units have developed rapidly in the state. More than 70 clusters have been formed in the state. As a result of the efforts of Chief Minister Shri Chouhan, the Government of India has approved 13 clusters. Efforts are being made to provide guidance to the youth in each district. Transfer of subsidy has made it easier for entrepreneurs to operate. Releasing the amount of subsidy in the last days of the financial year is like Sanjeevani for the entrepreneurs. Minister Shri Sakhalecha thanked Chief Minister Shri Chouhan on behalf of the entrepreneurs.

LIC's chairman will change from today, Siddharth Mohanty will now hold this post

MMNN: 14 March 2023

Business: Industrialist Gautam Adani's Adani Group has suffered huge losses since the report of Hindenburg Research firm. After that, it also came to light that the government insurance company Life Insurance Corporation of India (LIC) and the state bank State Bank of India (SBI) have huge investments in Adani group companies. Meanwhile, the government has appointed the current chairman of LIC MR. Kumar has refused to extend his tenure.

Siddharth Mohanty has been appointed by the government as the new interim chairman of LIC. He will take charge from March 14. Presently he has been appointed for 3 months. Siddharth Mohanty is currently the MD & CEO of LIC Housing Finance. Mohanty assumed office on 1 February 2021. That T.C. Took place of Sushil Kumar. Siddharth Mohanty is due to retire on 30 June 2023 and will continue in this position till then.

LIC informed the stock market that the Financial Services Department of the Ministry of Finance has appointed Siddharth Mohanty as the interim chairman of the company. This will be a separate charge from his duties as Managing Director of LIC. He will start serving as the interim president from 14 March 2021. It is noteworthy that LIC has invested Rs 30,127 crore in Adani group companies.

Madhya Pradesh's MSME department received the award from the central government

MMNN: 24 Feb 2023

MP News: Another achievement has been earned in the account of Madhya Pradesh. The Central Government has awarded the MSEFC Excellence Award-2022 to the Micro and Small Enterprises Facilitation Council for strong recovery procedure and quick disposal of cases, for resolving delayed payments of MSMEs of Madhya Pradesh.

Union Jal Shakti Minister Shri Gajendra Singh Shekhawat presented this prestigious award to Shri P. Narhari, Secretary, MSME Department and Industries Commissioner of Madhya Pradesh last day. Additional Secretary of Central MSME Dr. Rajneesh, Member of Laghu Udyog Bharti Mr. Mahesh Gupta, Rajesh Kumar Mishra and many officers were present.

Shri Narhari said that from January 1, 2022 to December 2022, 19 meetings of the council were held, in which a total of 472 cases were heard and final decisions were taken in 303 cases and uploaded in the departmental portal. Thirty crore 51 lakh 30 thousand 571 rupees were paid through award and settlement. The meeting of the Council is held on every first and third Friday and the facility of virtual hearing is also given to both the parties.

Mr. P. Narhari told that under Section 15 to 23 of the Central Government's Micro, Small and Medium Enterprises Development Act 2006, the supplier has the right that if he has supplied the material / service to the buyer, before 45 days from the due date Buyer is required to pay. If the payment is not made in time, then the supplier can claim 3 times compound monthly interest from the buyer under the Act under Section 18 of the Act.

MP News: Rs 7775 crore investment in MP, 5350 people will get employment

MMNN: 6 Dec 2022

MP News: Madhya Pradesh has now become an ideal state due to the evil of investment. Four big companies are going to invest in Madhya Pradesh, which will provide employment to 5350 people.

The unemployed of Madhya Pradesh are now going to get relief from unemployment. There has now become a possibility of employment for the unemployed on a large scale. With the investment of four big companies in Madhya Pradesh, 5350 people will get employment. These four companies will invest Rs 7775 crore in Madhya Pradesh

During discussion with various investors, Chief Minister Shivraj Singh Chouhan said that Madhya Pradesh has become an ideal state due to the evil of investment. The state government will also give full cooperation to the investors according to its policies. This investment has not only opened the way for starting a unit for manufacturing fertilizers from rock phosphate in Madhya Pradesh, but will also provide employment to 5350 people with an investment of Rs 7775 crore.

What did the investors say?

After meeting Chief Minister Shivraj Singh, Managing Director of Indian Phosphate Limited Ravinder Singh said that he is going to set up a plant at Meghnagar in Jhabua district at a cost of about Rs 200 crore, which will greatly benefit the farmers of Madhya Pradesh. Now they will not have to depend on other states for SSP and DAP. Indian Phosphate Limited is also investing for DAP plant in Sagar district. About 400 people will get employment from Jhabua and Sagar plants.

On the other hand, Anil Kumar Chalmala Shetty, Managing Director of M/s Greenco Group told that he is setting up a 1440 MW pumped storage plant at Gandhi Nagar in Neemuch district at a cost of Rs 7200 crore. Due to which this is an important project to promote hydro power in the state. Due to this there is a possibility of reduction in electricity rates. About 2500 people will get employment from this project.

Officials of ITC Limited Vadiraj Kulkarni and Rajnikant Rai after meeting Chief Minister Shivraj Chouhan told that they will provide employment to about 200 people by investing Rs 250 crore in Badhikhedi industrial area of Sehore district. On the other hand Baidyanath's Managing Director Pranav Sharma said that he is going to start a project for the manufacture of medicines from herbs in Chhindwara at Khairitagaon at a cost of Rs 125 crore, which will not only provide employment to about 2250 people, it will also benefit the tribal class. will also be particularly beneficial.

India becomes 5th largest economy, overtakes UK, France

MMNN:4 Dec 2022

MP: They encouraged international cooperation to further develop digital skills and digital literacy to harness the positive effects of digital transformation, especially for women, girls and people living in vulnerable situations.

The G20 special conference “Think 20 Global Governance with Life, Values and Well Being” will be organized by RIS (Research and Information System for Developing Countries), an organization of the Ministry of External Affairs, Government of India, on January 16 and 17 at the Kushabhau Thackeray Convention Center in Bhopal. The G20 Chief Coordinator, Government of India, Mr. Harsh Vardhan Shringla, Deputy Minister for Political, Law, Security and Defense Affairs, Ministry of National Development Planning, Indonesia, Dr. slamet soedarsono, Ambassador of the Netherlands to India, Mr. H.E. Maarten Wadden Berg and Mr. Uwe Gehlen, Head and Minister for Economic Cooperation and Development at the German Institute for International Cooperation, Germany will be specially present. About 70 Ministers from G20 member countries and more than 100 delegates from other states of India including guests will be present. All the guests will also be taken on a tour of Tribal Museum and UNESCO World Heritage Sanchi.

It is a matter of pride for the state to have the G20 meeting in Madhya Pradesh. The G20 is the leading forum for international economic cooperation. It plays an important role in determining and strengthening the global structure and governance on all major international economic issues. At this time, India has got the distinction of presiding over the G20.The G 20 includes Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, Turkey, the United Kingdom, the United States, and the European Union.

Principal Secretary Tourism and Culture Shri Shiv Shekhar Shukla and Principal Secretary Social Justice and Empowerment of Persons with Disabilities Department and Chief Executive Officer of Atal Bihari Vajpayee Institute of Good Governance and Policy Analysis Shri Prateek Hajela reviewed the arrangements for the conference in the ministry.

India becomes 5th largest economy, overtakes UK, France

MMNN:18 February 2020

New Delhi: India has emerged as the world's fifth-largest economy by overtaking the United Kingdom and France in 2019, a report from US-based thinktank said on Tuesday (February 18, 2020). In its report, the thinktank ''World Population Review'', said that India is developing into an open-market economy from its previous autarkic policies.

"India's economy is the fifth-largest in the world with a GDP of USD 2.94 trillion, overtaking the UK and France in 2019 to take the fifth spot," it said. The size of the UK economy is USD 2.83 Trillion and that of France is USD 2.71 Trillion, it added.

The report further said that in purchasing power parity (PPP) terms, India's GDP (PPP) is USD 10.51 trillion, exceeding that of Japan and Germany. Due to India's high population, India's GDP per capita is USD 2,170 (for comparison, the US is USD 62,794).

However, it said that India's real GDP growth is expected to weaken for the third straight year from 7.5 per cent to 5 per cent.

The report observed that India's economic liberalisation began in the early 1990s and included industrial deregulation, reduced control on foreign trade and investment, and privatisation of state-owned enterprises. "These measures have helped India accelerate economic growth," it said.

India's service sector is the fast-growing sector in the world accounting for 60 per cent of the economy and 28 per of employment, the report said, adding that manufacturing and agriculture are two other significant sectors of the economy.

The US-based World Population Review is an independent organisation without any political affiliations.

Air India as a brand will be preserved, all its operations will continue: Civil Aviation Minister Hardeep Singh Puri

MMNN:18 February 2020

New DelhiThe Centre will preserve Air India (AI) as a brand and continue all its operations, though there have been uncertainties about the airline in the recent past, said Civil Aviation Minister Hardeep Singh Puri on Monday. "Air India as a brand built by pilots, crew, commandant will be retained," said Puri.

In the Preliminary Information Memorandum issued a few weeks ago for Air India's stake sale, the government had stated that the brand name would have to keep as it is by the future owner.

Puri was speaking here at an event held to distribute the "Letters of Appreciation" issued by Prime Minister to the staff of Air India who conducted evacuation operation of the stranded Indians from the Wuhan city.

Speaking on its disinvestment, Puri said that the government will negotiate with the new buyer about a lock-in period for the existing Air India employees, adding that post that period employees can continue with the airline or switch to other airlines as they will have the option. He added that the government is confident of a very smooth transition.

The fact that Air India has been facing financial challenges is not something that is unknown, he added. "I don't think anyone can run an airline without the people that actually make it. Somebody asks what will happen to the staff. The staff will be required by whoever will be the new entity managing or owning it. There has been no recruitment for how many years. There is no surplus staff," he said.

"Don't ever be under the impression that this time around, there will be any problems (in disinvestment). There will not be. The amount of interest I am seeing in the acquisition and the quarters from where I am seeing it, I am reassured," he added.

Various employee unions of Air India in the last few months have expressed uncertainty about their future as the government has moved ahead with the stake sale plan.

The government expects to complete the sale of Air India in the first half of the next fiscal, according to the Department of Investment and Public Asset Management (DIPAM).

All Income Tax Exemptions To Go In The Long Run, Says Nirmala Sitharaman

MMNN:1 February 2020

New Delhi: Union minister Nirmala Sitharaman has said that the exemptions given to taxpayers now will eventually be removed. Speaking of the option given to tax payers in this union budget -- to remove exemptions and pay lower taxes -- Ms Sitharaman said while the intention this time was to "reduce rates and simplify structure", the government "will be able to gradually remove all exemptions".

For now, "Those who want to avail the benefits can follow the old method," the minister said at a press conference this afternoon, hours after she presented the union budget.

The new tax slabs announced today are:

5% tax for income between Rs 2.5-5 lakh

10% tax for income between Rs 5-7.5 lakh as against 20%

15% tax for income between Rs 7.5-10 lakh as against 20%

20% tax for income between Rs 10-12.5 lakh as against 30%

25% tax for income between Rs 12.5-15 lakh as against 30%

30% tax for income above Rs 15 lakh

But those who opt for it, will have to forego the exemptions granted under various heads, the minister said in her budget speech.

The exemptions that woould have to go under new rules would include the most commonly claimed ones under Section 80C for provident fund contributions, life insurance premium, school tuition fee for children and various specified investments such as ELSS, NPS, PPF etc.

It would also include the tax benefits on housing loan and house rent, mediclaim, leave travel allowance, family pension, interest on education loans, disability and donations to charitable institutions.

The minister, however assured that foregoing the exemptions would leave the salaried class richer under the new tax slabs. "You'll definitely benefit in terms of money that will remain in your hand under the new regime," she said.

Putting extra cash in people's hand is one of the ways which, the government hopes, will boost the sagging economy.

Over the last five quarters, the GDP growth has been on a downward spiral. It slowed to 4.5 per cent in the July-September quarter - the weakest pace since 2013. This is the biggest slowdown since the 2008-09 global financial crisis.

Government To Amend Companies Act To Decriminalise Civil Offences

MMNN:1 February 2020

New Delhi: The government proposes to amend the Companies Act to decriminalise civil offences, Finance Minister Nirmala Sitharaman said today as she announced Budget 2020. The Companies Act will be amended to remove criminal liability, she said.M

She also asserted that "tax harassment" would not be tolerated.M

"We are willing to put in law that tax harassment cannot be tolerated when we are talking about citizens," added the Finance Minister.M

She said a taxpayer's charter would be institutionalized to ensure citizens were free from tax harassment.M

One of the first to welcome the move to amend the Companies Act was Biocon's Kiran Mazumdar Shaw. "Finance Minister promises end to tax harassment to India inc. correcting Companies Act to decriminalise many non-compliances. A much-needed message to infuse trust," Ms Shaw tweeted.M

Reports suggest that offences that could be decriminalized would include corporate social responsibility (CSR) violations and non-filing of returns.M

Prime Minister Narendra Modi had earlier said that the government was working to decriminalise parts of the Companies Act to make it easier to do business in the country.M

Many provision of the law had already been decriminalised and work was on to bring in more changes, PM Modi had said.

Factory output shrinks, rising inflation at 5.5% begins to hurt

MMNN:1 December 2019

New Delhi: India’s industrial output shrank while inflation swelled, official data released on Thursday showed, highlighting challenges for policymakers battling an economic slowdown amid surging food prices.

Factory output contracted 3.8% in October after shrinking 4.3% in September, in sharp contrast with an 8.4% expansion in October last year. Retail inflation continued to surge in November, fuelled by soaring food prices, as prolonged rains dampened vegetable supplies.

Experts said if economic growth does not show signs of an uptick in the December quarter, the Reserve Bank of India (RBI) may come under pressure to give further monetary stimulus to support the economy, given the fact that retail inflation is driven by food prices and is not across the board. Vegetable prices surged 36% in November from a year ago, data released by the National Statistics Office showed.

Retail inflation surged 5.54% in November as food price inflation measured by the Consumer Food Price Index rose 10% in November from 7.89% in October.

Pointing to a demand slump in the economy, manufacturing output, which accounts for three-fourth of factory output, contracted 2.1% in October. The contraction in consumer durables deepened in October. Production of items such as cars and household appliances contracted 18% in October, after shrinking 9.9% in the month before.

Capital goods production that reflects investments in manufacturing continued its sharp contraction in October too. It has now contracted by over 20% for the last three months. Energy generation, seen as a proxy for living standards, too remained muted. Mining output covering mainly coal and crude oil contracted by 8% in October, and electricity generation by over 12%.

“The broad-based industrial weakness continues. The fiscal and monetary policy measures will have a lagged impact on the economy,” said DK Joshi, chief economist at Crisil Ltd. “If economic growth remains weak in the December quarter, then there is scope for monetary policy to further support economic growth.” He said the factors that may have an impact on retail inflation in the weeks ahead include higher telecom tariffs and a possible increase in goods and services tax rates.

According to Sunil Kumar Sinha, director of public finance and principal economist at India Ratings and Research, the industrial output figures clearly suggest that the festival season could not arrest the declining growth momentum of the industrial sector, resulting in the manufacturing sector clocking degrowth for the third consecutive month in November. “This is unprecedented as the new series of IIP with 2011-12 as base year so far has not witnessed such consecutive months of degrowth either in the manufacturing, electricity or the industrial sector as a whole,” said Sinha.

The government has announced various measures to support the automobile industry, exporters, non-bank lenders and housing financiers in addition to announcing a sharp corporate tax rate cut for domestic companies not availing of any tax breaks and to new manufacturing companies. RBI has so far cut its benchmark repo rate five times in a row this year totalling 135 basis points.

India’s economy grew 4.5% in the second quarter, its slowest pace since March 2013.

Saudi Aramco inches near $2 trillion in day 2 of trading

MMNN:1 December 2019

Saudi Arabia: Shares in Saudi Aramco gained on the second day of trading Thursday, propelling the oil and gas company to a near $2 trillion valuation, where it holds the title of the world’s most valuable listed company.

Shares jumped in trading to reach up to 38.60 Saudi riyals, or $10.29 before noon, three hours before trading closes. The market closed with prices settling at 36.8 riyals, or $9.81 a share, and 4.5% up. That gives Aramco a $1.96 trillion valuation.

Aramco has sold 1.5% of its shares to mostly Saudi and Gulf-based investors and funds on the local Tadawul exchange.

With gains made from just two days of trading, Aramco sits comfortably ahead of the world’s largest companies, including Apple, the second largest company in the world valued at $1.19 trillion.

Crown Prince Mohammed bin Salman is the architect of the effort to list Aramco, touting it as a way to raise capital for the kingdom’s sovereign wealth fund, which would then develop new cities and lucrative projects across the country that create jobs for young Saudis.

He had sought the mammoth $2 trillion valuation for Aramco when he first announced in 2015 plans to sell a small slice of the state-owned company.

International investors, however, thought the valuation was too high, given the relatively lower price of oil, climate change concerns and geopolitical risks associated with Aramco. The company’s main crude oil processing facility and another site were targeted by missiles and drones in September, knocking out more than half of Saudi production for some time. The kingdom and the U.S. have blamed the attack on rival Iran, which denies involvement.

Still, Aramco remains an attractive investment locally. It was the most profitable company in the world last year, earning $111 billion in net income.

In the lead-up to the flotation, there had been a strong push for Saudis, including princes and businessmen, to contribute to what’s seen locally as a moment of national pride, and even duty. Gulf-based funds from allied countries also contributed to the IPO, though it has largely been propelled by Saudi capital.

The kingdom’s decision not to list the company on a larger foreign exchange points to concerns that a global flotation would raise — including opening up the company to greater disclosure rules.

At a ceremony Wednesday for the start of trading, Aramco Chairman Yasir Al-Rumayyan described the sale as “a proud and historic moment for Saudi Aramco and our majority shareholder, the kingdom.”

To incentivize Saudi investors to hold their stock, Aramco has said Saudi citizens would be qualified to receive up to 100 bonus shares, or one for every 10 shares held, if they do not sell for 180 days from the start of trading.

Aramco has also promised to pay an annual dividend to shareholders of at least $75 billion until 2024.

#WhatIsYourBusinessPlanContest #MetroMirrorBusiness #MadhyaPradesh

Bhopal:MMNN: 12 November 2019

Team of 2/4 Dynamic Entrepreneurs (25-40) Invited ,who are willing to start a Small venture in the areas of Education/Skill Development / IT/Tourism/Media/ Advertising and PR/ Handicrafts/Ease of doing Business Solutions with complete details of Fixed and Working Capital,Infrastructure,Marketing Strategy, Revenue Model with five years projections. Selected Business Plan would get Rs 10000/- Prize and opportunity to get Seed capital, Equity participation and mentoring . Please send your complete Plan with details of the Team mentioning Strengths and weaknesses to Email : editormetromirror@gmail.com

Grand start to Magnificent MP unlike traditional style

MMNN:18 October 2019

Bhopal.The main programme of Magnificent MP in Indore commenced in a dignified manner, contrary to the traditional style amidst an atmosphere of trust for investors in the state. Guests were welcomed with an effective dance drama rather than the usual tradition of reception with garlands and bouquets. The attractive dance drama with varied colours mesmerized those present on the occaison.

Decisions and efforts made by the government to create an investment and industry friendly environment in the state were underlined through attractive presentation. A short documentary was screened showing the diversity, beauty and availability of resources of Madhya Pradesh. All the top industrialists from across the country including Chief Minister Shri Kamal Nath sat with the people who took part in Magnificent MP instead of the dias. This was probably the first time that a consecrated ceremony was concluded with a new tradition.

Government will adopt new methods to make state investment-friendly

MMNN:18 October 2019

Bhopal Chief Minister Shri Kamal Nath has said that the government will not back out in taking any steps and adopting new methods to make Madhya Pradesh an investment -friendly state. He called upon the industrial community to participate in the development of the state and help in maximum employment generation. The government is committed to welcoming new investment and encouraging earlier investment. We will work as an accountable government and will not let investors down. Chief Minister Shri Kamal Nath was addressing the “Magnificent MP” at Brilliant Convention Centre in Indore today.

CM Shri Kamal Nath said that today’s event is not for namesake and it is not a platform for signing of MoUs in which deals worth thousands of crores are made and are far from ground reality. The Chief Minister said that our goal is that actual investments are made, more employment opportunities are generated, the state becomes economically strong and a new era of economic activities begins in the whole state which will help every section of the society to flourish. He said that we want to take the state above the category of a state that provides products and service. The Chief Minister said that I want to tell the industrial groups and investors that in the current scenario, Madhya Pradesh is a state on which they can rely on. We want to make it clear that Madhya Pradesh puts its words into action. This is the reason why we are gathered here today. We have confidence in ourselves and our reliability is unwavering.

The Chief Minister said that the government is aware of the requirements of the industries. They want excellent, physical and social infrastructure. Shri Kamal Nath said that in the last ten months we have put in extra efforts and achieved the impossible. Major reforms have been made in the property guidelines to encourage real estate sector. Indore-Bhopal metro work has been started. Permit and license fee of colonizers have been reduced from 27 percent to 5 percent and a provision has been made to give one colonizers’ license to the entire state. The Chief Minister said that in the field of infrastructure development, Bhopal, Indore Industrial Corridor is being developed under which a satellite city will also be developed. R.R.T.S will be arranged to connect Bhopal and Indore to metro.

The Chief Minister informed that the government will provide additional facilities in tourism sector too in addition to the special facilities to the branded hotels. The Global Skill Park is being set up in the state in collaboration with the ITI Singapore. This will help in boosting skill development in the state. He further mentioned that Madhya Pradesh would be the first state of the country, where energy storage capacity will be established. As many as 2 lakh solar pumps have been made available in the agriculture sector. Solar power at low rates will be made available to the industries. In the cases of land transfer, instead of taking permission, the self-assessment is being encouraged. Along with this, the diversion charges are also being rationalised.

The Chief Minister further said that wide range reforms are being undertaken in the procedure of government and administration to create an industry friendly environment in the state. He called upon the investor community that they must tell the state government, what better could be done for the state and its citizens. We will cooperate with them as a responsible government, he added.

Welcoming the industrialists at the Magnificent Madhya Pradesh Summit, the Chief Secretary Shri S.R. Mohanty said that we want to make Madhya Pradesh, a prosperous and happy state with the partnership of the investors. In addition to agriculture, Madhya Pradesh enriches in forest and mineral wealth. Our geographical conditions are industrial friendly. The state government has made efforts, that the rules and processes should be made simple so that people wish to set up industry in the state should not face any difficulty. At the end, the Principal Secretary Industries Dr. Rajesh Rajoura proposed the vote of thanks.

On this occasion, the Vidhan Sabha Speaker Shri Narmada Prasad Prajapati, Minister for Public Works Shri Sajjan Singh Verma, Minister for Minor, Small and Medium Enterprises Shri Arif Aqueel, Minister for Commercial Taxes Shri Brijendra Singh Rathore, Minister for Health and Family Welfare Shri Tulsiram Silawat, Minister for Energy Shri Priyavrat Singh, Minister for Urban Development and Housing Shri Jaivardhan Singh, Minister for Higher Education Shri Jeetu Patwari, Minister for Science and Technology, Public Relations Shri P.C. Sharma and Minister for Finance Shri Tarun Bhanot, public representatives and concerned officers were present.

Foreign investment proposals worth Rs. 4385 crore in final stage in MP

MMNN:17 October 2019

Bhopal. Foreign investment proposals worth Rs. 4385 crore are in the process of consideration/final stage in Madhya Pradesh. These foreign investment proposals include proposal worth Rs. 1250 crore of Avgol Company, Rs. 258 crore of Treva Pharma of Israel, Rs. 400 crore of Bridgestone of Japan, Rs. 1000 crore of Statkraft of Norway, Rs. 375 crore of Parpharma of USA, Rs. 162 crore of Case New Holland and Rs. 90 crore of Teneco Automotive and Rs. 500 crore for expansion of P&G USA.

Our goal is to build a Magnificent Madhya Pradesh

MMNN:17 October 2019

Chief Minister Shri Kamal Nath has said that my priority is to give Madhya Pradesh a direction and vision that benefits every section of the state. He said that there is no dearth of resources in the state, the need is how to utilise them in building a ‘Magnificent Madhya Pradesh’. In the last ten months, we have made it clear with our intentions and policy in this direction that our goal is only development in which farmers get their price and the youth get work. Shri Kamal Nath was addressing the Business Leaders Madhya Pradesh Felicitation Ceremony organized by a private channel at Hotel Jehanuma today. On this occasion, Public Relations Minister Shri P.C. Sharma was present.

The Chief Minister said that Madhya Pradesh has immense forest and mineral wealth. Seventy percent of the state's population is dependent on agriculture. It is our priority to tsrengthen agriculture sectro and to increase the farmers income. We have reduced the burden of farmers through loan waiver. Now the biggest challenge before us is how to use surplus production so that the farmers get benefits. We are trying to build a bridge between agriculture and industry sector. Through the food processing units, the excess production of farmers will be utlised. He said that the meaning of GDP for us is that economic activities should increase in Madhya Pradesh. With this we will be able to increase people's purchasing power and this will also provide employment to people.

The Chief Minister said that we have linked investment with employment. First of all, investors should have confidence in Madhya Pradesh. We have worked in this direction and have also succeeded to a great extent. The Chief Minister said that the same investment is important to us and we will encourage the investment which will provide maximum employment and enhance economic activities. Referring to the creation of a conducive environment for the industries, he said that in the recent Cabinet meeting, we have taken important decisions which will help us in promoting investments. He said that in order to provide employment to 70 percent local people in the industries to be set up in Madhya Pradesh, we have made a provision in the industry policy. The Chief Minister said that we have also taken important decisions to make the system an investment friendly.

The Chief Minister said that our next step would be to strengthen the 'delivery system' of our welfare schemes. He said that at present, many government welfare schemes are going on, but due to poor implementation system, the benefits are not reaching the needy.

On recession in the country, the Chief Minister said that for this, we will have to bring comprehensive reforms in economic policies and make a system so that people get help without any difficulty. Shri Kamal Nath said that at present the decisions taken in the wrong direction, including GST, have weakened our economy.

Group Editorial Director Shri Raj Chengappa said that Madhya Pradesh is a fortunate state for having got a commander like Shri Kamal Nath. This is important because today the states of the country have to maintain the pace of development in this phase of recession. Shri Kamal Nath is the most capable person to meet this challenge. He said that in the last ten months of his tenure as Chief Minister, he has carved out an image of a skilled administrator, a working person and a person who achieves the goal. There is no difference between his words and actions. He believes that investment in Madhya Pradesh will come on trust, it cannot be begged. His experience will definitely take Madhya Pradesh to great heights.

Chief Minister Shri Kamal Nath felicitated nine notable industrialists associated with industries including manufacturing, service, export and other services in Madhya Pradesh at the Business Leaders Felicitation \Ceremony. Chairman and Chief Editor of India Today Group, Shri Arun Puri was present on the occasion.

India’s stock markets hit by worries over crude oil prices

India’s stock markets hit by worries over crude oil prices

Bhopal:MMNN:18 September 2019

Mumbai: Fears of a spike in crude prices in the wake of Saturday’s drone attack on Saudi Arabia’s Abqaiq oil facility triggered a sharp fall in India’s stock markets on Tuesday even though Brent Crude prices that jumped 15% to close at $69.02/barrel on Monday, the biggest intra-day jump since 2008, came down on Tuesday to trade at $64.06/barrel at 8.30 pm IST. India is the world’s third largest importer of oil.

Oil minister Dharmendra Pradhan said the development has created some “anxiety”. The events since Saturday are a matter of concerns to India but supplies from Saudi Arabia have not been disrupted, he told reporters after an industry meeting on Tuesday. “We have uplifted more than half of the contracted quantity for September. We uplifted oil yesterday [Monday] and even today [Tuesday],” he added.

Government officials said India was also exploring alternative sources and Russia could be a reliable partner for long-term supply of crude oil.

Still, fears that oil supplies from Saudi Arabia could be hit caused a meltdown in the markets with the BSE Sensex, India’s benchmark index, falling 1.73% over its previous close to end the day at 36,481.09 points. This is the third biggest intra-day fall in percentage terms this year. The BSE Sensex had fallen by 2.06% on September 3 when markets opened after the release of June quarter GDP figures and 8 July when imposition of capital gains taxes announced in the Budget on July 5 led to a large fall. Tuesday’s fall was spread across sectors, with each of BSE’s 19 sub-indices closing lower than previous day’s close. Auto and Realty indices suffered the most, closing 3.8% and 3.7% lower than the previous day’s close.

According to Shrikant S Chouhan, senior vice-president, Equity Technical Research, Kotak Securities, the fall in the Indian currency, crude prices and yield on 10-year bonds were dampening sentiment and “ spooked markets in the second half of the trading session when there was hardly any follow-up buying.”

To be sure, oil plunged nearly 7% in London later after Reuters said Saudi Arabia was close to restoring 70% of the oil production it lost over the weekend.

Chouhan’s reference was to the Indian currency touching a 10-month low in intra-day trading and bond yields falling; falling yields on government bonds indicate a real or perceived crisis in the economy.

To be sure, the panic in Indian markets could have been driven by a comment from MK Surana, chairman of state-owned Hindustan Petroleum Corporation Limited, who said on Monday that petrol and diesel prices could increase by up to ₹5 per litre if crude prices stayed at Monday’s levels. India’s Crude Oil Basket (COB) was priced at $59.35/barrel in August 2019. Average COB price was $66.76/barrel in the period from April to July 2019.

A spike in crude prices can prove to be a double whammy for India as it also leads to a depreciation in the rupee. The country imports more than 80% of crude oil it processes and pays in dollars.

This increases the prices further in rupee terms and has the potential of increasing the current account deficit as well as fiscal strain. India’s crude oil and petroleum imports have been falling compared to what they were a year ago for three consecutive months since June 2019.

Indian government officials said both oil and stock markets reacted sharply more because of sentiment than the actual situation. “The attacks on Saudi Arabian crude oil facilities have certainly disrupted the international oil market and India is also affected as the country is the second biggest supplier of crude oil (to us) after Iraq. But, we have a cushion for 10-15 days, and by then Saudi Arabia will be able to restore most of its supplies,” one official with direct knowledge of the matter said on condition of anonymity.

Indian refiners have crude storage for about 65 days. In addition to that, the country’s strategic reserves can sustain demands of refineries for another 10 days, officials said.

An executive working for a private sector refinery said on condition of anonymity that refineries have crude reserves for 7-10 days, which is sufficient for such contingencies. “Saudi Arabia is expected to restore supply in a week; meanwhile, alternative arrangements are being made in case of any further supply delays from Saudi Arabia,” the executive said.

The chief executive of another private sector refinery in India said, asking not be named, that “the surge in crude and product [such as petrol, diesel and petrochemicals] prices is temporary and situation will improve in a fortnight to a month.”

Citing the reasons for his optimism, he said: “First, global supply is 100 million barrels per day and the current disruption involves just 5 million barrels per day. Secondly, this 5 million barrel facility was meant to de-sulphurise crude to make it lighter. The company is thus unable to supply light crude, but it can supply unprocessed crude to those who have refineries to process such grade of crude. Thirdly, till date no refiner has faced any disruption of supply of crude from Saudi Arabia as the country has significant reserves. Hence, total impact could be around 1-2 million barrels per day, which will be normalised after sometime.”

Pradhan on Tuesday met Igor Sechin, chairman of the management board and CEO of Russian energy company Rosneft and discussed matters related to India’s energy security. “The developments in energy markets, including global crude oil supplies, in the light of the recent attacks on Saudi Aramco’s facilities, was also discussed. In this context, a special focus was on increase of crude oil supplies from Russia to Indian refineries,” an oil ministry official said, asking not to be named.

“Rosneft indicated their readiness to intensify their cooperation aimed at the strengthening of energy security in India and in supplying of high-quality feedstock and crude oil to India,” the official added.

Pradhan welcomed the ongoing discussions between Indian oil marketing companies and Rosneft to finalize a term-contract for the supply of Russian crude oil to India, and mentioned that this is part of India’s efforts to diversify its sources of crude oil, the official said.

Former chairman of the Oil and Natural gas Corporation (ONGC), RS Sharma, said: “India is vulnerable to such oil disruptions because it is heavily dependent on imported oil. Although, the current reaction is more out of sentiment, situation could be grim if the geopolitical tension escalates.”

While there is no immediate threat of an oil shortage-driven spike in prices, some experts believe that the attack on Saudi oil facilities could give a structural push to oil prices. “In the long term, oil prices will likely add a geopolitical risk premium of at least $5 to $10 into the price until the odds of another strike are reduced,” Rob Thummel, managing director at Tortoise Advisors, a firm that makes energy investments, told The New York Times. COB prices have been increasing in India every year after they crashed to $46.17/barrel in 2015-16. The average price of COB was $47.56 in 2016-17, $56.43 in 2017-18 and $69.88 in 2018-19.

A day after US President Donald Trump appeared to point the finger at Iran, which denies the accusations that it was behind the attack, he appeared to temper his warning.

Trump said he was ready to help Riyadh following the strikes, but would await a “definitive” determination on who was responsible.

Car registrations down in Delhi for first time in 6 years

Car registrations down in Delhi for first time in 6 years

Bhopal:MMNN:18 September 2019

Mumbai: Reflecting a slump in automobile sales on the back of slower economic growth and consumer spending and local factors such as traffic congestion and parking constraints, vehicle registrations in the national capital have declined in the first eight months of 2019, the first drop for the period in six years, according to data from the ministry of road transport and highways and the state transport department.

The number of registrations, an indicator of sales, fell by 61,198 units to 425,691 in January-August from 486,889 vehicles that were registered in the same period last year. The 12.6% decline in the period is the first since 2014, the data shows. Two-wheeler registrations fell by over 13%, or 43,182 units, to 286,467.

Indian automobile sales have declined for 10 months in a row and in August posted the steepest drop ever, reflecting a downturn in consumer spending and overall economic growth, which slowed to 5% in the quarter ended June, the slowest pace in 25 quarters. According to data released by the Society of Indian Automobile Manufacturers (SIAM), passenger vehicle sales plunged 31.57% year-on-year to 196,524 units in August. Passenger car sales fell 41.09% to 115,957 units.

The August fall marked the worst decline for both the categories since SIAM started recording the data in 1997-98. Truck and bus sales dropped 39%. Two-wheeler sales fell 22% to 1.5 million units. The slump in auto sales had led to job losses in the sector as automakers, parts manufacturers and dealers let go of employees to cut costs.

Vehicle registrations have been particularly low in June, July and August. For example, around 49,000 vehicles were registered in August this year compared to 62,000 in August 2018, over 54,000 in 2017, around 56,000 in 2016 and around 54,000 in 2015 and 46,249 in 2014.

Demand for two-wheelers, which make up over 7.3 million or over 63% of the 11 million registered vehicles in Delhi, has seen a steep decline for the first time ever. Registrations of scooters and motorcycles fell 13.1% in the first eight months of this year.

Data on car registrations indicated that except in 2017, demand in Delhi has been declining gradually over the years. This year, the decline in the number of registrations has accelerated to a steep 10.7%. Transport minister Kailash Gahlot said Delhi, one of the biggest markets for automobiles in India, has suffered in terms of revenue as well. “Revenue earned by the state transport department through vehicle registrations and road tax has seen a decline since 2018, which is because of the slowdown in the economy. But this year, the fall in revenue has been steep — nearly 7%,” he told HT. In 2017, revenue collected by the department was around Rs 1,300 crore which has fallen to Rs 1,176 crore this year. During the same period in 2018, revenue was Rs 1,258.39 crore.

Dealers acknowledged there has been a considerable decline in the number of bookings. “Bookings have decreased this year. But since August the numbers have become almost negligible. We are now looking forward to the GST Council meeting, scheduled on September 20. There are talks that the GST on automobiles will be reduced from 28% to 18%. If that happens, then the demand will spike,” said RK Arora, owner of Krish Automotors Private Limited.

Experts said the demand downturn reflects a few local factors as well as the larger downturn. “Parking is a major cause [of the slowing demand for cars] in Delhi. People are becoming pragmatic and highly money- minded now. The sheer wastage of time in being stuck in traffic and then finding a space to park your vehicle is now making people believe that taking a cab instead is more convenient,” said Tutu Dhawan, automobile expert and classic car restorer. He added that the abundance of cabs coupled with a wider Metro rail network has pushed more people to avoid personal transport.

Sentiment in the automobile market has been downbeat because of factors such as higher petrol prices and costlier third-party insurances, said Sugato Sen, deputy director general of the Society of Indian Automobile Manufacturers (SIAM). “The increase in the cost of insurance is an important reason. Prices of every vehicle went up by about 10% because of this,” he said.

Other dealers said a reason for the slump in vehicle sales could be the compliance with stricter Bharat Stage-VI emission norms that kick in from April next year. “This will make vehicles costlier. As a result, many, at present, are just waiting (for a time) when dealers will start offering heavy discounts on cars and two-wheelers to clear their BS-IV inventory,” said a prominent dealer in the city who asked not to be named.

Jio GigaFiber, Saudi Armaco deal and J&K: What Mukesh Ambani said at RIL meet

Jio GigaFiber, Saudi Armaco deal and J&K: What Mukesh Ambani said at RIL meet

Bhopal:MMNN:12 August 2019

Mumbai:

At the 42nd Annual General Meeting (AGM) of Reliance Industries on Monday, the company’s chairman and managing director Mukesh Ambani said that “India is getting transformed into New India, Reliance will also transform itself into New Reliance”.

Announcing the biggest foreign investment in the history of Reliance, Ambani said that Saudi Aramco has agreed to acquire 20% stake in RIL’s oil-to-chemical business for an enterprise value of $75 billion. He also said that much awaited wired broadband service Jio GigaFiber will start from September 5 at rates which are one-tenth compared to global rates. Investment cycle of Reliance Jio, the Reliance chairman said, is complete and it has amassed over 340 million subscribers in less than three years, is now ready to fire four new growth engines including Internet of Things (IoT) for the entire country.

The 10 big announcements at Reliance AGM:

1. Speaking at the annual event, held at Birla Matushri Sabhagar in Mumbai, Mukesh Ambani said the slowdown in some sectors is temporary and that the country’s fundamental are very strong. “Future of India and future of Reliance never looked brighter to me than now. Our Prime Minister has set the goal of making India a five trillion dollar economy by 2022. I fully endorse the idea. In fact, I see India becoming a 10 trillion dollar economy by 2030.

2. Mukesh Ambani also said that his company would make several announcements for Jammu & Kashmir and Ladakh region in the near future. “Responding to the Prime Minister’s appeal, we stand committed to support people of Jammu and Kashmir and Ladakh in all their developmental needs. Hence, we will create a special task force and you will see several announcements for Jammu & Kashmir and Ladakh region in our developmental initiatives in the coming months,” he said at the 42nd Annual General Meeting (AGM).

2. On the much-awaited wired broadband service Jio GigaFiber, he said the service will offer internet speeds of 100 mbps, going up to 1,000 mbps; to be priced at Rs 700 to Rs 10,000 a month depending on the usage plans, which will combine wired broadband, television content, landline calling and a host of smart solutions such as multi-player gaming and video conferencing.

3. JioGigaFiber has received over 15 million registrations from 1,600 cities and the company has drawn up a plan to reach 20 million homes and 15 million business enterprises.