Latest news

FSDC meeting discusses global financial turmoil and India's economic stability

FSDC meeting discusses global financial turmoil and India's economic stability

NEW DELHI:MMNN: 12 may 2023

Finance Minister Nirmala Sitharaman chaired the 27th Meeting of the Financial Stability and Development Council (FSDC) on 8th May 2023. This was the first meeting of the FSDC after the announcement of the Budget 2023-24. The FSDC is the apex body of sectoral regulators, headed by the Union Finance Minister. In the program Spotlight of Akashvani, AK Bhattacharya, Economic Analyst discussed the agenda and significance of the meeting.

The meeting was aimed at taking stock of the threats, challenges, and opportunities for India's financial sector and ensuring that it remains stable amidst the global turmoil. The Economic Analyst pointed out that in today's interconnected world, it is impossible to insulate any sector of the economy from global headwinds or tailwinds, especially in the financial sector. Hence, it is crucial to recognize this interconnectedness and put necessary safeguards in place so that the Indian financial sector can withstand any shocks without causing any undue harm to customers, investors, or shareholders.

Oil prices slide 1% as US inventory levels surge

Oil prices slide 1% as US inventory levels surge

NEW DELHI:MMNN: 10 may 2023

Oil prices on Wednesday fell around one percent ending a three-day rally as an unexpected rise in U.S. oil inventories sparked demand concerns. Investors also awaited inflation data for cues on U.S. interest rates.

In intra-day trade, Brent crude was trading at 76 dollars and 80 cents per barrel while West Texas Intermediate crude price was at 73 dollars per barrel when reports last came in.

India's economic success hailed at Asian Development Bank meet in South Korea

India's economic success hailed at Asian Development Bank meet in South Korea

NEW DELHI:MMNN: 9 may 2023

India's economic success hailed at Asian Development Bank meet in South Korea

Finance Minister Nirmala Sitharaman led the Indian delegation to the 56th Annual General Meeting of the Board of Governors of Asian Development Bank (ADB) in South Korea. Economic analyst ShankkarAiyer and Akashvani correspondent Rajesh Lekh participated in a discussion on the event in the program Spotlight.

According to Aiyer, the center of gravity of economic growth has shifted to the Indian Ocean region, where India is in pole position as the fifth largest economy in the world and soon to be the fourth. The Finance Minister's visit showcased India's potential as the fastest-growing large and raised issues such as climate change and innovative financing for climate finance.

ADB's objective is to envision a prosperous, inclusive, resilient and sustainable Asia and the Pacific, while eradicating extreme poverty in the region. The Finance Minister's interactions with global economists, governors, and finance ministers of ADB member countries were centered on the reconfiguration of the supply chain post-pandemic and poverty alleviation.

India's success in creating a digital and physical infrastructure that contributes singularly and cumulatively to poverty alleviation has been repeatedly mentioned at the Fund Bank Meetings and ADB Meetings, according to Aiyer. The world has lauded the Aadhar identity platform, which creates inclusive accounts with the Jandhan, Aadhar, and Mobile trinity, and the success of the National Payments Corporation and UPI. At least seven or eight countries have shown interest in creating a similar identity platform.

The Economic analyst pointed out that in the post-pandemic world, the supply chain story has moved from just-in-time supply chain to just-in-case supply chain. India has become part of the solution to a resilient global supply chain which gives a potential to GDP growth, trade and a better current account deficit.

Hence, the annual meeting of ADB is an occasion for India to present its point of view on geopolitics, climate change, and financing, and to represent Global South. With the meeting, the Finance Minister has showcased India's rise and potential at the global stage.

RBI, BIS launch global technology competition ‘G20 TechSprint’

RBI, BIS launch global technology competition ‘G20 TechSprint’

NEW DELHI:MMNN: 5 may 2023

Reserve Bank of India(RBI) and Bank for International Settlements (BIS) have launched G20 TechSprint, a global technology competition. RBI and the BIS Innovation Hub have jointly announced the fourth edition of the G20 TechSprint. RBI said that the 2023 TechSprint will focus on developing innovative technology solutions for cross-border payments. The competition is open for developers around the world for submitting application from today to 4th June. The results will be announced at a final event in August or September this year.

Shortlisted teams will be invited to develop their solutions over a six-week period and each team will be eligible for a stipend of eight lakh rupees approximately 10,000 US dollar. An independent panel of experts will select the most promising solution to each problem statement from the shortlisted solutions. The winners for each problem statement will receive an award of forty lakh rupees approximately 50,000 US dollar.

Ethanol sector growth has been tremendous which set sort of example for world: Piyush Goyal

Ethanol sector growth has been tremendous which set sort of example for world: Piyush Goyal

NEW DELHI:MMNN: 3 may 2023

Union Minister of Commerce and Industry Piyush Goyal has said that the growth of the ethanol sector has been tremendous which has set a sort of example for the world. Addressing a National Seminar on 'Maize to Ethanol’ in New Delhi, he said that in the last 9 years, the sugar sector has been self-sufficient with more than 99.9 per cent payment to farmers for the previous season.

He added that now, ethanol will support maize farmers in increasing their income and bringing growth with stability on the lines of sugarcane farmers. The Minister said that investment of thousands of crores have come creating thousands of jobs in the rural sector which has generated a multiplier effect on the Indian economy. Mr. Goyal highlighted that environment friendly fuel like ethanol has been on the top priority list of Prime Minister Narendra Modi.

He said, it has resulted in more than doubling of ethanol blending in just 2 years and the target of 20 per cent ethanol blending has also been preponed from 2030 to 2025. The Minister said that timely planning, industry friendly policies and transparent approach of the Union Government with collaboration of industry has made these achievements a reality.

Finance Minister Nirmala Sitharaman directs CBIC to implement action plan to increase taxpayer base through enhanced use of technology

Finance Minister Nirmala Sitharaman directs CBIC to implement action plan to increase taxpayer base through enhanced use of technology

NEW DELHI:MMNN: 29 April 2023

Finance Minister Nirmala Sitharaman has directed the Central Board of Indirect Taxes and Customs (CBIC) to implement an action plan to increase the taxpayer base through enhanced use of technology. Ms Sitharaman said this while chairing a review meeting with CBIC in New Delhi today. She also directed CBIC to introduce its automated GST return scrutiny by next week.

During the meeting, the Finance Minister was briefed on the final revenue achievement in total Indirect Tax collections for 2022-23. It stood at Rs 13 lakh 82 thousand crore, as against Rs 12 lakh 89 thousand crore in 2021-22. On the GST side, the average gross monthly collection for the year 2022-23 stood at Rs one lakh 51 thousand crore. The monthly GST revenue collections exceeded Rs one lakh 40 thousand crore for 12 months in a row. The comprehensive review covered a variety of work areas including trade facilitation, taxpayer services, grievance redressal of the trade, finalisation of disciplinary cases and infrastructure projects.

Ms Sitharaman emphasised the need for continuously improving taxpayer services. In order to intensify its drive against fake billing and Input Tax Credit, the Minister asked CBIC to undertake a comprehensive root cause analysis by studying the typology of cases already booked. She asked them to come up with recommendations on technology-based solutions to address the menace and prevent its occurrence.

Reliance joins hands with Warner Brothers and HBO: Soon you will be able to watch great series like Game of Thrones and Harry Potter on Jio Cinema

Reliance joins hands with Warner Brothers and HBO: Soon you will be able to watch great series like Game of Thrones and Harry Potter on Jio Cinema

NEW DELHI:MMNN: 27 April 2023

Movies and shows like Game of Thrones, Harry Potter, Succession and Discovery will soon be available on the Jio Cinema app. For this, Mukesh Ambani's company Viacom18 has a deal with Hollywood's well-known production house Warner Bros Discovery Inc. After this deal, Jio Cinema will give direct competition to Amazon Prime Video and Disney Hotstar. Viacom18 and Warner Bros said, movies and shows on Jio Cinema will premiere in the US only. Previously, Disney had the rights to stream content from Warner Bros. and HBO. This partnership ended on 31 March 23. For this reason Indian viewers were not able to stream shows like HBO's Game of Thrones. Warner Bros. is the parent company of HBO.

Warner Bros' content will be available only on Jio Cinema

News agency Reuters wrote quoting sources that this partnership will be exclusive. That is, Warner Bros. shows and movies will not be able to offer most of their popular movies and series to other Indian OTT platforms including Amazon Prime Video and Disney Hotstar. Farzad Palia, Head - Subscription Video-on-Demand and International Business, Viacom18, said, "Jio Cinema has become the largest platform for live sports. We are now on a mission to make Jio Cinema the most magnetic destination for entertainment.Jio is showing IPL for free

This time live streaming of IPL is happening for free in 4K quality. Jio Cinema is the official live-streaming partner of IPL 2023. Earlier, IPL was shown on Disney Hotstar. In such a situation, Hotstar subscription had to be taken to watch it. Right now you do not have to pay any fee to watch anything on Jio Cinema.Subscription will have to be taken on Jio Cinema,

in an interview given to Bloomberg in the past, Reliance's Media and Content Business President Jyoti Deshpande had said that there is a plan to release more than 100 movies and web series on Jio Cinema. New content will be released before the end of IPL 2023. Jio Cinema will start charging for original content. Although Jyoti Deshpande told that the company has not yet finalized the Jio Cinema plan, the price will be decided soon. Deshpande had said that the current OTT platform is dominated by foreign content.5.5 billion unique views in Jio Cinema

Jio Cinema has claimed that the platform has received 5.5 billion unique video views in the first week of IPL. And on April 12, 2023, a record 22 million people watched the Chennai Super Kings vs Rajasthan Royals match in Jio Cinema. Let us tell you that IPL has started from March 31, whose last match will be played in Bengaluru on May 21. PM Svanidhi's scheme gives small loans to needy people without CIBIL score: MoS Finance Bhagwat Karad

PM Svanidhi's scheme gives small loans to needy people without CIBIL score: MoS Finance Bhagwat Karad

NEW DELHI:MMNN: 24 April 2023

Union Minister of State for Finance Dr. Bhagwat Karad today asked bankers to focus on banking the unbanked, securing the unsecured, and funding the unfunded. He was speaking at a review meeting on the Financial Inclusion Parameters of Western Maharashtra in Satara today. The Minister further said that PM Svanidhi's scheme gives small loans to needy people without the condition of collateral or a CIBIL score. The Minister also exhorted bankers to increase banking penetration in rural areas. He directed banks to reduce the waiting period for loan disbursement. The Minister added that even a developed State like Maharashtra has scope for increasing the number of bank branches in rural areas. Shri Karad further stated that the banking sector is a big pillar in the target towards becoming a five trillion economy. The Minister further added that new customers should be incorporated into the banking sector by opening their bank accounts, and special camps should be arranged for the same. He suggested imbibing a competitive spirit in the banking sector for the development of all. The Minister on this occasion appreciated the all round performance achieved by Kolhapur District on Financial inclusion parameters.

Apple's store in Delhi after Mumbai, know who will benefit and who will be harmed

Apple's store in Delhi after Mumbai, know who will benefit and who will be harmed

NEW DELHI:MMNN: 20 April 2023

After Mumbai, the world's leading tech company Apple, which manufactures iPhone, is now going to open its store in Delhi as well. iPhone and other Apple products are already being sold in the country. But tremendous enthusiasm is being seen in the country regarding Apple's stores. The question arises that what is going to be the benefit of opening Apple's store? The reason for this is that the way Apple has changed the retail business in the world, its example is rarely seen. The company opened its first retail stores in 2001 in California and Virginia. To reduce dependence on other retailers and better showcase its products, the company decided to open its own stores. Now it has become a status symbol in a way. Apple has 272 stores in the US alone. Today Apple's stores are in more than 20 countries of the world. After America, it has the maximum number of 45 stores in China. There are 39 stores in the UK, 28 in Canada, 22 in Australia, 20 in France, 17 in Italy and 16 in Germany. Apple is the largest company in the world by market cap. The biggest feature of Apple's store is its design. Apple has a unique way of displaying products in its stores. Also, users get a different experience in this. Huge crowds are seen outside Apple stores during the launch of new products in the US and Europe. Apple's store in Mumbai is inspired by Kaali Peeli Taxi

what will be the benefit

All employees at Apple Stores have a mobile POS. This makes it easy to sell products. That is, you do not need to stand at the bill counter. You can make payment at the counter where you are checking the product. The biggest advantage of buying products from the Apple Store is that you get exclusive deals and offers there. For example, if you are a student, you can get the benefit of back to university offer. In the US, the company gives a gift card of $ 150 under this. Not only this, if you buy a product from Apple's store, then you can give it a personal touch according to your own. Till now the company used to sell its products through exclusive Apple premium partner stores, major retailers and trade and e-commerce platforms. The company says that the new retail locations will expand its business in India. With these stores, the company's customers in India will be able to explore new products. It is believed that in its stores, the company will also set up experience centers for the customers. This will cause some loss to the retailers. Retailers are apprehensive that with the opening of Apple stores in Mumbai and Delhi, the number of their customers may decline by 50 to 60 percent.who will be harmed

Mumbai and Delhi account for 20 per cent of the total annual sales of iPhones in India. Some say that Apple will first release the stock for its stores. This may harm the rest of the retailers. However, sources in the company have dismissed this apprehension. He says that the entire retail ecosystem will benefit from the opening of Apple's retail stores. Navneet Pathak, general secretary of All India Mobile Retailers Association, said that the company would like to create similar hype in Delhi and Mumbai during the new launch. Existing Apple customers may want to visit these stores before purchasing a new product. Although some people do not give it much preference. He says that 80 percent of Apple's new customers come from small towns. In such a situation, two Apple stores are not going to make much difference. Google CEO Sundar Pichai hints at more layoffs, wants to ensure efficiency

Google CEO Sundar Pichai hints at more layoffs, wants to ensure efficiency

NEW DELHI:MMNN:13 April 2023

New Dehli: Google CEO, Sundar Pichai, has hinted at another round of layoffs at Google. In January this year, Google decided to fire six per cent of its workforce, leaving 12,000 Googlers without a job.

Sundar Pichai was speaking with the Wall Street Journal when he hinted towards more layoffs. However, he did not directly address the subject.

He also discussed Google's work in the artificial intelligence (AI) domain. He said that Google's chatbot Bard was being integrated into products like Gmail and Google Docs to increase efficiency.

He said, "We're very, very focused on this set of opportunities we have, and I think there's a lot of work left. There's also an important inflection point with AI. Where we can, we are definitely prioritizing and moving people to our most important areas, so that is ongoing work."

Sundar Pichai said they were looking into every aspect of Google's work and taking steps to re-engineer its cost base permanently. He said that Google aims to increase its efficiency by 20 per cent. He stressed that Google needs to build upon the improvements it has made in recent times.

He added that job cuts were made after careful consideration. He said, "We've decided to reduce our workforce by approximately 12,000 roles. We've already sent a separate email to employees in the US who are affected. In other countries, this process will take longer due to local laws and practices."

Nita Mukesh Ambani Cultural Centre to open doors to audience on March 31

:MMNN: March 31 2023

A multi-disciplinary cultural space, India’s first-of-its-kind, the Nita Mukesh Ambani Cultural Centre, will open on March 31 with an exquisite showcase of the best of India across music, theatre, fine arts and crafts to audiences from India and the world.

The launch will feature a specially curated art and craft exposition called ‘Swadesh’ along with three blockbuster shows – a musical theatrical called ‘The Great Indian Musical: Civilization to Nation’; a costume art exhibition called ‘India in Fashion’ and a visual art show called ‘Sangam/Confluence’.

Together these will present the diversity of India’s cultural traditions and their impact on the world while also showcasing the diversity of spaces at the cultural centre.

Speaking on the eve of the inaugural day, Nita Ambani said, “Bringing this cultural centre to life has been a sacred journey. We were keen to create a space for both promoting and celebrating our artistic and cultural heritage in cinema and music, dance and drama, literature and folklore, arts and crafts and science and spirituality. A space where we showcase the best of India to the world and welcome the best of the world to India.”

The centre will offer free access for children, students, senior citizens and the differently-abled. It will focus on community nurturing programmes, including school and college outreach and competitions, awards for art teachers, in-residency programmes and art literacy programmes among others.

‘The Great Indian Musical: Civilization to Nation’ will see a line-up of exceptional Indian talent, along with a Tony & Emmy award-winning crew, and has been conceived and directed by Feroz Abbas Khan. The marquee production will bring together talents such as Ajay-Atul (music), Mayuri Upadhya, Vaibhavi Merchant, (choreography) along with 350+ artists, including an epic 55-piece live orchestra from Budapest, to showcase India’s cultural journey through history. The visual spectacle will also feature over 1,100 costumes designed by leading fashion designer Manish Malhotra.

The cultural centre, located within the Jio World Centre at Bandra Kurla Complex, is home to three performing arts spaces: the 2,000-seat Grand Theatre, the technologically advanced 250-seat Studio Theatre, and the dynamic 125-seat Cube.

It also features the Art House, a four-storey dedicated visual arts space built as per global museum standards with the aim of housing a shifting array of exhibits and installations from the finest artistic talent across India and the world.

Spread across the centre’s concourses is a captivating mix of public art by renowned Indian and global artists, including ‘Kamal Kunj’ – one of the largest Pichwai paintings in India.

Invest in the right place for higher returns on FD: Many banks including SBI and HDFC have increased interest rates, see here where more interest is now

Invest in the right place for higher returns on FD: Many banks including SBI and HDFC have increased interest rates, see here where more interest is now

NEW DELHI:MMNN:24 February 2023

New Dehli: Due to increasing the repo rate of RBI this month, most of the banks have announced to give higher interest rate to the customers on FD investment. In this sequence, many banks including SBI, HDFC Bank, PNB and Yes Bank have recently increased their FD interest rates. The new interest rates will be applicable for investment amount less than Rs 2 crore

State Bank of India (SBI) has increased interest rates on select FDs by up to 25bps on 15 February 2023. New interest rates Interest rates up to 7 percent have been announced for tenure ranging from 7 days to 10 years tenure. Senior citizens can earn up to 7.5% interest on SBI Fixed Deposit. The bank is paying 7.1 percent interest to ordinary citizens and 7.6 percent to senior citizens on special FD Amrit Kalash with the highest interest rate of 400 days tenure.

HDFC Bank has made new interest rates on FD effective from 21 February 2023. The bank gives an opportunity to invest in FDs for a period ranging from 7 days to 10 years. HDFC Bank is offering interest rates ranging from 3% to 7.10% to the general public and 3.50% to 7.60% to senior citizens.

Private sector leader Yes Bank has increased the interest rate on FDs by 25 to 50 basis points on 21 February 2022. Yes Bank offers investors an opportunity to earn hefty returns on tenure ranging from 7 days to 10 years. The bank is offering interest rates ranging from 3.25 per cent to a maximum of 7.50 per cent for regular citizens. At the same time, it has been announced to give interest rate ranging from minimum 3.75 percent to maximum 8 percent interest rate to senior citizens. The highest interest rate is being given to ordinary citizens at 7.75 per cent on FD with a tenure of 35 months. Whereas, it has been announced to give 8.25 percent interest to senior citizens investing on the same period.

Punjab National Bank (PNB) has increased FD interest rates by up to 30bps on 20 February 2023. The highest interest rate offered by the bank to regular citizens is 7.25 per cent for a tenure of 666 days. The bank has offered an interest rate of 7.75 per cent to senior citizens for FDs with a tenure of 666 days and 8.05 per cent to super senior citizens with a tenure of 666 days.

G20 Summit 2022: Looking for the role of G-20 amid global crises, expert view

G20 Summit 2022: Looking for the role of G-20 amid global crises, expert view

NEW DELHI:MMNN: 19 Nov 2022

Today, about 14 years ago, the global economy suffered a major setback, when the Asian financial crisis slowed down the rate of economic growth and once again from 2020, the world economy is going through a severe economic crisis and many Big countries are also finding themselves unable to make economic recovery. One thing that is worth noting in both these times of economic crises is the role of the G-20 organization.

Seeing the effects of the Asian financial crisis, the G-20 was formed in 1999 and now again when the world is surrounded by economic, geo-political storms, once again the G-20 conference was held recently in Indonesia to find a solution. K is done in Bali. A special thing that should be noted in this conference is that now the developed countries of G-20 have recognized the role and potential of emerging market economies like India, Brazil and South Africa to bring the global economy back on track. started.

The proof of this is also that India will organize G-20 in the year 2023, while Brazil and South Africa will organize it in 2024 and 2025 respectively. The declaration of G-20 issued in Bali shows that developed and developing countries are considering G-20 as the most effective means of global economic recovery. Perhaps that's why keeping aside their economic differences and ambitions, there seems to be an agreement among the nations to ensure global economic cooperation by abandoning economic protectionist policies.

The Russia-Ukraine war and other geopolitical tensions have badly affected the economy of European countries, especially the UK. Therefore, at the Bali Summit of the G-20, the nations said that they oppose Russia's barbaric and bestial mentality of war and want Russia to stop its military action against Ukraine without any conditions, Because war is now heading towards a huge human tragedy and rule based international order and democratic values do not allow any country to sacrifice global peace, security and economy for its personal ambitions.

Before the G-20 meeting held in Bali, US President Joe Biden and Chinese President Xi Jinping also said that there should be no nuclear war under any circumstances. Both countries have also said that war can never be won with nuclear weapons. Both countries have also condemned Russia's nuclear threats to Ukraine. Such an approach by China is giving a different kind of courage to the western countries, because China is able to be candid on very few occasions.

The G-20 does not want the critical supply chain in the world to collapse, the members of the G-20 do not want the countries that have been affected by the Kovid epidemic to face war-borne energy problems. G-20 countries want that now work should be done for such a sustainable development, so that the fears of economic recession can be eliminated. This echoes the theme of Indonesia's G20 presidency, "Recover Together, Recover Stronger". For the timely achievement of the Sustainable Development Goals, the G-20 countries have asked the Multilateral Development Banks to increase both the volume and speed of financial cooperation in this direction, so that it can be easier for the nations to deal with the food problem.

Budget 2019 Brings Cheer to Startup Sector as Govt Promises 1 Lakh Digital Villages

Budget 2019 Brings Cheer to Startup Sector as Govt Promises 1 Lakh Digital Villages

NEW DELHI:MMNN:2 February 2019

Mumbai: The startup sector has welcomed the interim budget proposal of setting up one lakh digital villages saying that it will give boost to the sector.

Taking forward government's Digital India programme, Finance Minister Piyush Goyal Friday said that the government has set an aim of building one lakh digital villages in the next 5 years.

The initiative to set up of one lakh digital villages when rolled out will have multiplier effect on startups in segments like edutech, content based companies, media tech and of course fintech and e-commerce," Unicorn India Ventures managing partner Anil Joshi said.

This will ensure faster financial inclusion of people who still continue to be outside of formal banking system and have no credit history. Startups working in fin tech and edutech should see this as a promising opportunity to tap the unaddressed and underserved rural population, Joshi said.

City-based cyber security startup Sequretek welcomed the government's focus on artificial intelligence, as other countries have already made a start by investing heavily in AI and lead initiatives to become a data rich economy. Bengaluru-based fin tech startup in direct lending segment Smartcoin said the initiative to build one lakh digital villages would mean more money being transacted digitally as the country possibly has the lowest penetration

when it comes to mobile and data tariffs in the world.

"Digitally progressive would also mean better internet connectivity and hence we expect the untapped rural consumers to start using digital payments. For us, this means more alternate data generated to assess loan seekers. And over time a formal credit history will be built, as they will not only transfer money but also take micro loans for their needs. For a fin tech company in

direct lending space like ours, this is a huge push to achieve our vision of bringing under banked masses under a formal credit system, it said.

Noting the move to enhance tax exemption for salaried employees and digitising the entire tax filing process, Fintech company Zeta's co-founder Bhavin Turakhia said, "The decision to carry all tax verifications via an anonymous digital interface and processing all tax returns within 24 hours displays the government's strong intention to build a digital nation, whilst putting convenience in the hands of its citizens and ensuring complete transparency."

Wearable devices-maker Goqii that is backed by Ratan Tata and Paytm founder Vijay Shekhar Sharma, among others, said healthcare announcements made in the budget are a welcome move and will help build a strong economy.

Union Budget 2019: Top 5 Announcements By Piyush Goyal In Election Year

Union Budget 2019: Top 5 Announcements By Piyush Goyal In Election Year

NEW DELHI:MMNN:1 February 2019

NEW DELHI: Union Minister Piyush Goyal today presented the last Interim Budget of the NDA government led by Prime Minister Narendra Modi before the Lok Sabha elections due by May. From direct cash transfer to small farmers and better gratuity terms to income tax relief, the Interim Budget appeared to be keeping the national elections in its radar.

Here are the top 5 announcements by Piyush Goyal:

1-Individual taxpayers with annual income up to Rs. 5 lakh will get full tax rebate. Individuals with gross income up to Rs. 6.5 lakh will not need to pay any tax if they make investments in provident funds and prescribed equities. Around three crore middle class taxpayers will get tax exemption due to this measure.

2-Within the next two years, assessment of all tax returns should be done electronically without any personal interface. Direct tax collections up from 6.38 lakh crore in 2013-14 to almost 12 lakh crore; tax base up from 3.79 crore to 6.85 crore. All income tax returns to be processed within 24 hours.

3-The PM Kisan Samman Nidhi Yojana will provide assured income support of Rs. 6,000 per year to small and marginal farmers with landholding below two hectares, through direct cash transfer. It will be paid in three installments of Rs. 2,000.

4-"EPFO shows two crore accounts in two years. This shows formalisation of the economy. When there is such a high growth, jobs are created," Piyush Goyal said. Gratuity limit has been increased from Rs. 10 lakh to Rs. 30 lakh.

5-Pension scheme for unorganised sector workers with monthly income up to Rs. 15,000 will be given. Assured monthly pension of Rs. 3,000 after they retire on reaching 60.

Cabinet approves merger of Vijaya Bank, Dena Bank into Bank of Baroda

Cabinet approves merger of Vijaya Bank, Dena Bank into Bank of Baroda

NEW DELHI:MMNN:3 January 2019

New Delhi, The Union Cabinet on Wednesday cleared the merger of Bank of Baroda, Vijaya Bank and Dena Bank.

The Bank of Baroda would be the transferee bank while Vijaya Bank and Dena Bank would be transferor banks, Union Minister Ravi Shankar Prasad told a press conference after the Cabinet meet.

Mr Prasad said the merger would come into force from new financial year April 1, 2019.

The Cabinet was held under the chairmanship of Prime Minister Narendra Modi here.

Jet Airways Defaults On Debt Payment To Banks, Shares Plummet Nearly 6%

Jet Airways Defaults On Debt Payment To Banks, Shares Plummet Nearly 6%

NEW DELHI:MMNN:2 January 2019

Cash-strapped Jet Airways said late Tuesday it defaulted on debt payment to a consortium of banks, prompting ratings agency ICRA to downgrade the carrier and sending its shares sharply lower. The payment of interest and principal instalment was delayed "due to temporary cash flow mismatch", Jet said in a statement, adding that it was in talks with the consortium led by State Bank of India. The deadline for payment was Monday, December 31.

ICRA cut Jet's long- and short-term ratings on Wednesday, citing the payment delays.

Timely implementation of liquidity initiatives, including equity infusion and a stake sale in the airline's loyalty programme Jet Privilege, will be critical to the company's credit profile, ICRA said.

The 25-year-old airline is facing financial difficulties and owes money to pilots, lessors and vendors. Intense pricing competition, a weak rupee and rising fuel costs weighed on the country's airlines in 2018.

Jet, the country's biggest full-service carrier by market share, had a debt of Rs. 8,052 crore ($1.15 billion) as of September 30, 2018.

Jet and its second-largest shareholder, Etihad Airways, are in talks with bankers on a rescue deal that may involve the Abu Dhabi-based airline increasing its stake from 24 per cent at present.

The airline's shares declined as much as 5.84 per cent in their sharpest intraday drop in over three weeks and were last down 5.27 per cent at Rs. 266.00, as of 2:33 pm on the NSE.

SAIL must keep pace with new growing companies: Birender Singh

SAIL must keep pace with new growing companies: Birender Singh

NEW DELHI:MMNN:29 December 2018

New Delhi, Times are changing and SAIL must keep pace with the new and fast growing steel companies, Union Steel Minister Chaudhary Birender Singh said on Friday.

Outlining four mantras for SAIL — Speed, Aggression, Innovation and Loyalty — the Minister said decisions, actions and projects need more speed and marketing.

He said new areas and markets like North-East need to be explored and technology, thinking and working has to be innovative and all this will happen only if those associated with SAIL have loyalty and commitment towards the company and country.

Mr Singh was addressing an event, organised to commemorate the 60 years of the SAIL foundation here.

The Minister exhorted SAIL to invest in research and development, technology development and production of high-grade, value-added steel as these are the priorities of the government and SAIL has a crucial role to play in all these areas.

“National Steel Policy, 2017 has set ambitious target of 300 MT steel capacity by 2030-31 and SAIL with 1/6th of the proposed capacity is going to be a key contributor. However, all this must be done in a systematic and planned way. Each plant and unit has to adopt the culture of ‘Safety First’.”

Stressing that the culture of safety has to be an integral part of the working, he said the Ministry will observe daylong of the year as Safety Day for the steel sector from 2019.

Minister of State for Steel Vishnu Deo Sai expressed hope that with its continued hard work, SAIL will be able to fulfill the right expectations of the country in future too.

The first furnace of Rourkela Steel Plant began functioning in 1959 setting the foundation for building India’s economic development. SAIL nowadays is a Maharatna company and the largest steel producer and also the highest iron ore miner in India. Steel is a deregulated sector and SAIL operates in open economy producing 21.4 million tonnes steel per annum and contributing 1.5 times of India’s GDP and 6.8 times to employment generation.

Steel Ministry Secretary Binoy Kumar and SAIL Chairman Anil Kumar Chaudhary and top officials of Ministry of Railways and other Central Government departments were also present on this occasion.

Prabhu launches AirSewa 2.0; says improving service quality is on priority

Prabhu launches AirSewa 2.0; says improving service quality is on priority

NEW DELHI:MMNN:20 November 2018

New Delhi, Union Civil Aviation Minister Suresh Prabhu on Monday said the focus is on improving the quality of services so that passengers who are travelling have a safe and comfortable experience.

He said a need was felt for development of an upgraded version of AirSewa to provide a superior user experience with enhanced functionalities. Major improvements include features such as secure sign-up and log-in with social media, chatbot for travellers support, improved grievance management such as social media grievances, real-time flight status and details flight schedule.

Mr Prabhu said this after launching the upgraded version of AirSewa 2.0 web portal and mobile app here along with Minister of State for Civil Aviation Jayant Sinha.Mr Prabhu said the upgrade and improved version of AirSewa will offer passengers a convenient and hassle-free air travel experience. The web portal and application will help to capture air travellers’ feedback for policy interventions.

Speaking on the occasion, Mr Sinha said today, five crore passengers have been travelling every year and would grow exponentially in the near future. There was an urgent need of upgrading AirSewa and systemic intervention in improving customer services.

Air passengers, he said, face issues like flight delays, problem in refunds, long queues, inadequate facilities at airports and complaints of lost baggage and his Ministry launched AirSewa web portal and mobile app in November 2016 to address this need.

The AirSewa 1.0 was received well, with around 30,000 app downloads and around 75,000 web portal hits since its launch. It has helped significant number of air passengers to get their concerns resolved with 92 per cent closure rate for grievance solutions. In addition to grievance redressal, AirSewa also provides real-time flight status and flight schedules, he added.

The junior Minister said further upgrades of AirSewa are also being planned which would include DigiYatra registration, airport maps, BHIM payment integration and grievance escalation and transfer.

The two Ministers also gave away the champion award to Chennai airport which saw 100 per cent timely closure of grievances in one year.

RBI Board, Govt meeting underway to solve rifts

RBI Board, Govt meeting underway to solve rifts

NEW DELHI:MMNN:19 November 2018

New Delhi/Mumbai, A crucial meeting of the Reserve Bank of India and the Government is underway on Monday to draft new prompt corrective actions for weak lenders amid increasing non-performing assets and bad loans, providing liquidity to non-banking financing companies and new capital guidelines for the central bank.

The RBI Board of Directors include five full time members — RBI Governor Urjit Patel, Deputy Governors N S Vishwanathan, Viral V Acharya, B P Kanungo and Mahesh K Jain.

The Government has inducted Department of Economic Affairs Secretary S C Garg and Department of Financial Services Rajiv Kumar into the Board as its representative. The Board has also 11 independent directors.

The meeting is also expected to take up issues of resolving liquidity crunch to lend sufficient capital to non-banking finance companies in wake of IL&FS defaults.

It may also frame new prompt corrective actions (PCA) for weak banks amid growing bad loans in order to make them stable and stand on their own feet.

The meeting is likely to also discuss the issue that there should be sufficient capital and easier norms for small and medium businesses.The issue of RBI reserve surplus is also expected to surface in the meeting of which the Central Bank is not in favour.

Besides, sources say the government has recommended that the RBI Board frame rules and regulations such as financial stability and monetary policy transmission. However, the Bank wants that these regulations should be draft by experts only.

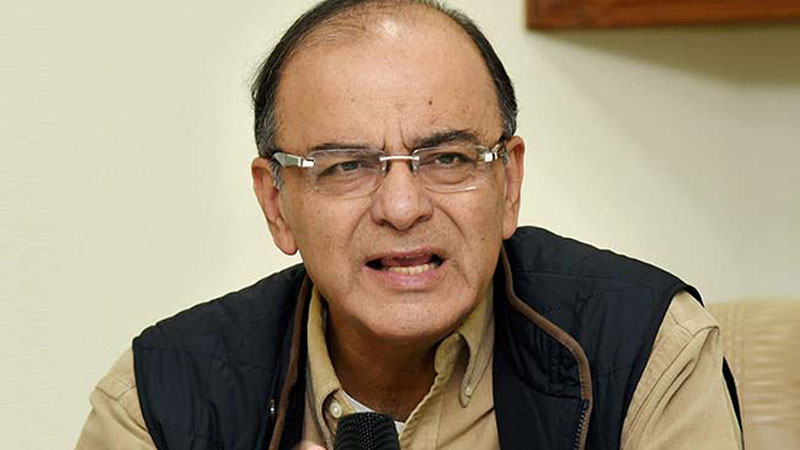

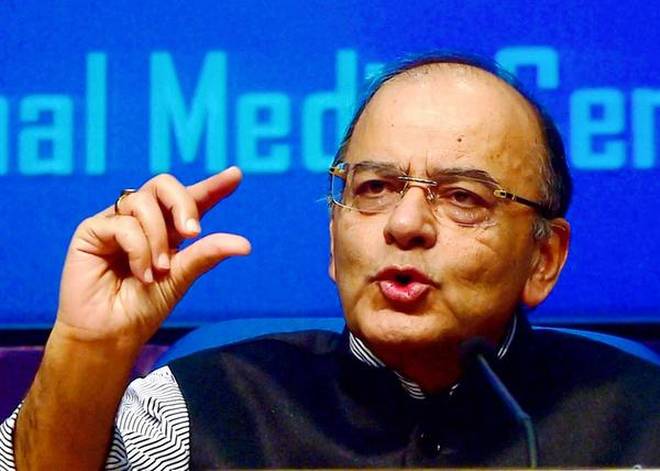

NDA govt has influenced aspirations of low-income people: Jaitley

NDA govt has influenced aspirations of low-income people: Jaitley

NEW DELHI:MMNN:16 November 2018

New Delhi, The NDA Government’s achievement in financial inclusion have in a way influence the aspirations of low-income population, leading to improve lives in rural areas, Union Finance Minister Arun Jaitley said on Thursday.

Mr Jaitley said the government in just four years has achieved remarkable results as it has opened numerous bank accounts under the Jan Dhan Yojna, providing funds to Start-Ups and covered the rural areas.

“Within a short span of time, what started of as a financial inclusion experiment, we have been able to achieve remarkable results in banking the unbanked, securing the unsecured, funding the unfunded and covering the uncovered rural areas. Our achievements in financial inclusion have in a way influenced the aspirations of the low-income population. This has led to improving the rural sanitation, providing better quality of life to poorer population in the villages,” the Minister added.

The Finance Minister said the subject of digital financial inclusion is a topic of extreme importance to a country like India where they have adopted a higher growth rate to propel development.

He was speaking at the 25th World Congress of Savings and Retail Banks organised here.

NABARD chairman Dr Harsh Kumar Bhanwala said the financial inclusion model adopted by India has contributed to inclusive growth and laying down a huge digital infrastructure which can be used by state governments for providing various benefits to the poorer population.

He said the NABARD has also enabled outreach to more than 100 million rural women through partnerships with over 60,000 bank branches and over 5,000 civil society organisations. Savings plays a very critical role in all the financial inclusion approaches promoted by NABARD.

Mr Bhanwala said NABARD is also in the process of digitisation of self-help groups, which contributes to intensification of credit, convergence of various government benefit schemes and providing better business opportunities for banks with over 100 million members of SHGs.

Speaking on the occasion, outgoing WSBI President Heinrich Haasis provided a summary of achievements made during his six-year association presidency, including inroads made toward a WSBI pledge to provide “an account for everybody”, which was outlined in a 2012 WSBI declaration in Marrakesh.

“Since our World Bank Universal Financial Access 2020 commitment made in 2015, WSBI members have added 340 million accounts for 234 million people into the formal financial system thanks to their efforts,” he added.

Department of Financial Services Secretary Rajiv Kumar was also present on the occasion

SAIL Declines Dividend To Government Citing Cash Crunch

SAIL Declines Dividend To Government Citing Cash Crunch

NEW DELHI:MMNN:31 August 2018

New Delhi: State-owned Steel Authority of India Ltd (SAIL) has declined a government call for a dividend this year, saying it did not have "any cash and bank balance" and that its debt-to-income ratio was much higher than agreed with some lenders, showed an internal company document reviewed by Reuters. SAIL's refusal could make it harder for the government to meet its budgeted target of raising Rs. 1.06 lakh crore ($14.95 billion) from the dividends and profit of state-owned companies this fiscal year ending March. Last fiscal year, the government received Rs. 123 crore, 13 per cent below the then target.

India's second-biggest steel firm by current production said it was due to pay out Rs. 2,171 crore including tax to the government based on its "net-worth" last fiscal year. "SAIL does not have any cash and bank balance and would need to borrow from the market for payment of dividend," SAIL said in an explanation sent to the government expressing its inability to pay the dividend.

"It is getting increasingly difficult to borrow further from the market in the current market conditions, especially for the steel sector, as the financial institutions and banks are reluctant to take further exposure on steel industry."

A SAIL spokesman told Reuters that the firm posted a loss in the 2017/18 fiscal year "so there is no chance of a dividend".

The Ministry of Finance did not respond to a request for comment.

The document also showed SAIL's net debt-to-earnings before interest, taxes, depreciation and amortization (EBITDA) ratio was 8.5, against the 1.5 to 3.75 "the company in financial covenants agreed to with some of the foreign lenders".

The firm has Rs. 3,220 crore debt due for repayment this fiscal year, which will have to be "met from borrowed funds".

"In the last three quarters, the company has been in profit and production is also ramping up although the loans do exist. But this year, the company will end up showing net profit in toto," the spokesman said.

Hike in fuel prices; petrol rise by 14 paise, diesel 15

Hike in fuel prices; petrol rise by 14 paise, diesel 15

NEW DELHI:MMNN:29 August 2018

New Delhi, With no relief in sight for consumers, diesel recorded a hike of 15 paise while petrol prices went up by 14 paise on Tuesday.

In Delhi, petrol prices will now cost Rs 78.05 per litre, diesel Rs 69.91 per litre, according the Indian Oil Corporation data.

In Mumbai and Kolkata, petrol was at Rs 85.47 and Rs 80.98 respectively. In Chennai, it was priced at Rs 81.09.In Mumbai, Kolkata and Chennai, diesel was priced at Rs 73.90, Rs 72.46 and Rs 73.54 per litre respectively.

On May 29, petrol prices were at an all-time high. In Delhi, Kolkata, Mumbai and Chennai petrol was being sold at Rs 78.43, Rs 81.06, Rs 86.24 and Rs 81.43 per litre respectively.

The surge in fuel prices is largely attributed to the recent rise in crude oil price and the high excise duty levied on transportation fuel in the country.

Rupee Edges Higher, Still Below 70 Mark Against Dollar

Rupee Edges Higher, Still Below 70 Mark Against Dollar

NEW DELHI:MMNN:28 August 2018

The rupee rose mildly against the US dollar to close at 70.10 on Tuesday. That marked a recovery of 6 paise against the greenback, compared to the all-time closing low of 70.16 registered in the previous session. Selling of the US currency by exporters and banks amid fresh inflow of foreign funds supported the rupee, say analysts. Weakness in the dollar, which declined to its lowest level recorded in nearly a month against a group of six major currencies, also provided some support to the rupee.

The rupee had advanced to 70.02 at the day's highest point, but limited the upside by the end of the session.

The United States and Mexico agreed on Monday to overhaul the North American Free Trade Agreement (NAFTA). The trade deal pushed the dollar lower against a basket of major currencies as investors sought riskier assets and the greenback's safe-haven appeal declined.

"With the US reaching a bilateral agreement with Mexico, the dollar index has dropped from 96 to 94 levels. However, with Brent oil inching up to $75 / barrel, rupee will continue to be under pressure," Salil Datar, CEO and executive director, Essel Finance VKC Forex, told NDTV.

International crude oil prices rose towards their highest since July 11, thanks to evidence of still-modest increases in output from OPEC and improving Chinese refining demand. Brent crude oil futures were around $76.65 a barrel in recent trade.

Meanwhile, domestic stock markets continued their record-setting spree. BSE benchmark index gained 202 points to close at a record 38,896 while the NSE Nifty settled above the 11,700 mark for the first time. Continued inflows by institutional investors pushed the stock markets higher.

Foreign portfolio investors (FPIs) net purchased equities worth Rs. 252.52 crore while net buys by domestic institutional investors (DIIs) stood at Rs. 1,117.24 crore on Monday, according to provisional data from the NSE.

Analysts will closely watch the GDP growth data for the April-June quarter due on Friday.

"We expect Rs. 70/dollar now to be the new normal. With the GDP data expected this week, we expect rupee to range between Rs. 69.75-70.40," Mr Datar added.

Gold Demand Falls As Kerala Floods Hit Festival Buying

Gold Demand Falls As Kerala Floods Hit Festival Buying

NEW DELHI:MMNN:25 August 2018

Mumbai/Bengaluru: Demand for physical gold was modest in India this week as the top bullion consuming state of Kerala coped with floods, while interest for the metal remained lacklustre elsewhere in Asia as buyers awaited a dip in prices. Gold demand usually sees a jump in Kerala during the festival of Onam, but this year, the southern state is reeling from some of the worst floods in a century, leaving thousands displaced and causing damage of at least Rs. 20,000 crore ($2.85 billion).

"Demand has taken a hit in Kerala. For the next few weeks, demand will remain sluggish there as people are focusing on building their damaged homes," said Harshad Ajmera, the proprietor of JJ Gold House, a wholesaler in the eastern Indian city of Kolkata.

Dealers in India were charging a premium of up to $1.25 an ounce over official domestic prices this week, compared to a premium of $1 the last week. The domestic price includes a 10 per cent import tax.

Local prices have risen more than 1 per cent in a week due to the depreciating rupee and that is prompting some jewellers to postpone purchases, said a Mumbai-based dealer with a private bank.

In the Indian market, gold futures were trading around Rs. 29,635 per 10 grams on Friday, after falling to Rs. 29,268 last week, the lowest level since Jan. 10.

Meanwhile, global benchmark spot gold prices hit $1,201.51 an ounce on Wednesday, its highest since August 13, and were set to register their first weekly gain in seven.

In top consumer China, premiums rose to $6-$8 an ounce this week from last week's $3 to $5, while premiums in Hong Kong were little changed at 90 cents-$1.40 versus 90 cents to $1.50 previously.

"When prices went down to $1,160-$1,170, people were happy to buy, but nobody wants to chase up on this ($1,200) level," said Ronald Leung, chief dealer at Lee Cheong Gold Dealers in Hong Kong.

Premiums in Singapore also remained largely unchanged at 80 cents to $1.50 an ounce compared with 90 cents-$1.50 last week.

"Demand in Singapore is slightly subdued right now... if the prices move down by $5-$10, I think we will see a lot of demand," said a Singapore-based banker, adding that there is a lot of demand around the $1,175 price level.

Japan premiums inched down to 75 cents-$1 an ounce versus $1 last week as higher prices muted demand, a Tokyo-based trader said.

Tata Sons Cannot Force Cyrus Mistry To Sell His Shares: Tribunal

Tata Sons Cannot Force Cyrus Mistry To Sell His Shares: Tribunal

NEW DELHI:MMNN:24 August 2018

New Delhi: In a partial relief to Cyrus Mistry, the National Company Law Appellate Tribunal (NCLAT) on Friday stated that Tata Sons cannot force him to sell his shares. However, the two-judge bench headed by Justice S.J. Mukhopadhyaya, declined Mistry's appeal to stay the conversion of Tata Sons into a private company. The court said it will decide on conversion of Tata Sons into a private company after the final hearing on September 24.

Further, NCLAT has admitted Mistry's appeal against his removal from the post of Tata Sons' Chairman in 2016. The appeal was against the order of the NCLT, Mumbai bench.

Infosys CFO MD Ranganath Resigns To Pursue Professional Aspirations

Infosys CFO MD Ranganath Resigns To Pursue Professional Aspirations

NEW DELHI:MMNN:18 August 2018

Infosys Ltd announced that the board at it's meeting on Saturday accepted the resignation of M D Ranganath, as the Chief Financial Officer (CFO) and key Managerial Personnel of the company. Ranganath will continue in his current position as Chief Financial Officer till November 16, 2018. The board will immediately commence the search for the next Chief Financial Officer, said a press release issued by the company. Ranganath had been appointed as the CFO of India's second-biggest software services exporter in 2015, a press release issued by the company said.

During his long tenure of 18 years in Infosys, Mr Ranganath has been a part of the Infosys Leadership team and has played several leadership roles in the areas of consulting, finance, strategy, risk management and M&A and has worked closely with the board and its committees in formulating and executing strategic priorities for the company, said Infosys.

In tendering his resignation, Ranganath stated that, "After a successful career spanning 18 years in Infosys including as CFO for the last 3 crucial years, I now plan to pursue professional opportunities in new areas"

On his resignation, Salil Parekh, Chief Executive Officer said, "Ranganath and I have worked closely over the past few quarters in shaping the strategic direction of the company. I admire his strong financial acumen, deep understanding of the company's business and ability to deliver consistent results. He played a crucial role as the CFO and provided strong leadership for the company. I am confident that over the next few months Ranganath will ensure a smooth transition. I thank him for his lasting contribution and wish him all the best."

Rupee Hits Fresh Record Low Of 70.32 Against US Dollar: 10 Points

Rupee Hits Fresh Record Low Of 70.32 Against US Dollar: 10 Points

NEW DELHI:MMNN:16 August 2018

The rupee hit a fresh record low of 70.32 against the US dollar in early trade on Thursday. Experts believe that the rupee is unlikely to recover soon. Asia's currencies also remained under pressure, with the dollar holding near 13-month peaks as political turmoil in Turkey and concerns about China's economic health continued to support safe-haven assets. However, the government said on Wednesday that the foreign exchange reserves are comfortable by global standards and can combat any undue volatility in the rupee.

Here are 10 things you should know about rupee's trade today:

The rupee opened at a record low of 70.25 a dollar and weakened further to trade at a fresh low of 70.32, down by 43 paise, reported news agency Press Trust of India (PTI). At 9:13 am, the rupee was trading at 70.25/26 per dollar, versus its Tuesday's close of 69.90/91. Markets were closed on Wednesday for a national holiday, reported news agency Reuters.

Experts attributed the fall in rupee to the trade deficit hitting a 5-year high. "The trade deficit is the major trigger for today's fall in the rupee. Even though the Turkish lira has recovered, the dollar index continues to move higher. The rupee will recover when global market stabilizes. I think, the rupee will remain under pressure in the next few sessions," said Rushabh Maru, Research Analyst, Anand Rathi Share and Stock Brokers.

The trade deficit for July widened to a more than five year high of $18.02 billion, driven largely by a surge in oil imports.

Even if the rupee appreciates, the appreciation would not sustain for long due to global uncertainty, Mr Maru added.

PTI reported forex dealers as saying that besides strong demand for the American currency from importers, capital outflows mainly weighed on the domestic currency.

Furthermore, depreciation of the Turkish lira against the dollar after the US imposed tariffs on steel and aluminium imports also put pressure on the Indian rupee, they added.

On Wednesday, Union Minister Arun Jaitley said, "Recent developments relating to Turkey have generated global risk aversion towards emerging market currencies and the strengthening of the dollar. However, India's macro fundamentals remain resilient and strong. The developments are being monitored closely to address any situation that may arise in the context of the unsettled international environment."

On Tuesday, the rupee settled at 69.90 against the greenback, after weakening to a fresh all-time low of 71.10.

Meanwhile, oil prices recouped some of the previous day's losses after Beijing said it would send a delegation to Washington to try to resolve trade disputes between the United States and China that have roiled global markets. International Brent crude oil futures were at $70.93 per barrel at 0335 GMT or 9:05 am IST, up 17 cents, or 0.26 percent, from their last close, reported Reuters.

Since a weaker rupee is positive for IT companies, tech stocks traded higher. The Nifty IT index traded 0.29 per cent higher as seven out of 10 stocks advanced. At 9:52 am, the Sensex traded at 37,778.08, down 73.92 points or 0.20 per cent and the Nifty50 was at 11,415.90, down 19.20 points or 0.17 per cent.

Gold Prices Fall For Second Straight Day: 5 Things To Know

Gold Prices Fall For Second Straight Day: 5 Things To Know

NEW DELHI:MMNN:14 August 2018

Gold prices fell for second straight day on Tuesday even as global prices of the yellow metal recovered from 17-month lows hit on Monday. Safe haven buying did not help lift gold prices, said experts. Strength in the dollar led to weakness in the rupee which hit an all-time low of 70.09 against the US dollar. There was a lot of economic turmoil after the Turkish lira hit a record low against the US dollar on Monday. Investors traditionally use gold as a means of preserving the value of their assets during times of political and economic uncertainty and inflation, but it has this year failed to benefit, according to a report by news agency Reuters. Silver too plunged by Rs. 335 to Rs. 38,715 per kg due to poor offtake by industrial units and coin makers.

Here are five things you should know about gold, silver trade today:

Gold eased by Rs. 30 to Rs. 30,630 per 10 gram, driven by a subdued global trend amid tepid demand from local jewellers, stated news agency Press Trust of India.

"Safe haven buying did not help gold at all as the metal fell to 17-month lows yesterday, following strength in US Treasuries and a stronger dollar as investors eyed a financial market rout triggered by a crashing Turkish lira. Today even as the domestic currency recovered from all-time low, prices of the yellow metal stayed weak," Jigar Trivedi, Fundamental Research Analyst - Anand Rathi Commodities. Furthermore, sluggish demand from local jewellers and retailers at domestic spot market fuelled the downtrend in gold rates, said market men.

In the national capital, gold of 99.9 per cent and 99.5 per cent purity fell by Rs. 30 each to Rs. 30,630 and Rs. 30,480 per 10 gram, respectively. The precious metal had lost Rs. 40 in Monday's trade.

Silver ready dropped by Rs. 335 to Rs. 38,715 per kg and weekly-based delivery by Rs. 310 to Rs. 37,740 per kg. On the other hand, silver coins held steady at Rs. 73,000 for buying and Rs. 74,000 for selling of 100 pieces.

In global markets, spot gold was up 0.2 per cent at $1,195.77 an ounce, as of 0341 GMT (9:11 am IST). US gold futures were up 0.3 per cent at $1,202 per ounce

Reliance Industries Reports Record Profit Of Rs. 9,459 Crore In April-June?

Reliance Industries Reports Record Profit Of Rs. 9,459 Crore In April-June?

NEW DELHI:MMNN:28 July 2018

Reliance Industries on Friday reported a record net profit of Rs. 9,459 crore for the April-June period. The energy conglomerate had registered a net profit of Rs. 9,108 crore for the quarter ended June 2017, which included exceptional items worth Rs. 1,087 crore representing profit from divestment of stake in Gulf Africa Petroleum Corporation. Revenue for the three-month period ended June 30, 2018 stood at Rs. 1.41 lakh crore, 56.5 per cent higher compared with Rs. 90,537 crore in the year-ago period.

"We continue to focus on strong delivery through operational excellence in our portfolio of businesses. Financial results of 1Q FY19 underscore the strength of the petrochemicals we have reinforced over the last investment cycle. Our petrochemicals business generated record EBITDA with strong volumes and an upswing in polyester chain margins," said chairman and managing director Mukesh Ambani.

"Refining business performance remained steady despite the seasonal weakness in cracks. Continuing strength in global demand for oil products and implementation of more stringent environmental norms for marine fuels augurs well for our refining business," he said.

On a standalone basis, Reliance Industries' profit - which includes the Indian oil-to-retail conglomerate's refining, petrochemicals and oil and gas exploration and production businesses - was Rs. 8,820 crore versus Rs. 8,196 crore a year ago. The standalone number excludes retail and telecom operations. That compared with an average estimate of Rs. 8,643 crore from 10 analysts, according to Thomson Reuters.

Reliance Jio Infocomm, the telecom arm of Reliance Industries, posted a third straight quarterly net profit, as its cut-price plans continued to bring in more customers. Reliance Jio, which provides telecom services under brand Jio, posted a profit of Rs. 612 crore ($89.15 million) in the quarter ended June 30, versus Rs. 510 crore in the previous quarter. (Also read: Reliance Jio doubles customer base in 12 months, says Mukesh Ambani)

On performance of Reliance Jio, Mr Ambani said: "215 million customers within 22 months of start is a record that no technology company has been able to achieve anywhere in the world."

Shares in Reliance Industries ended 1.6 per cent higher at Rs. 1,128 on the NSE, ahead of the earnings announcement by the company.

Vodafone Idea Gets Final Government Approval: Report?

Vodafone Idea Gets Final Government Approval: Report?

NEW DELHI:MMNN:26 July 2018

Department of Telecom has given final approval to Vodafone, Idea Cellular merger, news agency Press Trust of India reported citing government sources. At 3:15 pm, Idea Cellular shares were trading 4 per cent higher at Rs. 57.20 on the BSE, whose benchmark index was up 140 points at 36,998.

The combination will create India's largest mobile-phone company and help the firms compete with billionaire Mukesh Ambani's Reliance Jio Infocomm Ltd., which upended the world's second-largest mobile-phone market by offering free calls and cheap data. Idea has reported losses every quarter since Jio started services in September 2016.

The merger, announced in March 2017, will topple current market leader Bharti Airtel Ltd. and create a behemoth with 438.8 million subscribers.

HDFC AMC IPO Opens: Should You Subscribe?

HDFC AMC IPO Opens: Should You Subscribe?

NEW DELHI:MMNN:25 July 2018

The IPO or initial public offer of HDFC Asset Management Company (AMC) opened for subscription on Wednesday. It is the most profitable AMC and the second largest in terms of assets under management (AUM) with a 14 per cent market share. By 4:00 pm, the 1.88 crore issue had received 1.77 crore bids. That meant a subscription of 0.94 times for HDFC AMC IPO, according to data from the National Stock Exchange or NSE. The price band of HDFC AMC IPO - worth an estimated estimated Rs. 2,787-2,800 crore - has been set at Rs. 1,095-Rs. 1,100.

HDFC Asset Management Co (HDFC AMC) is the asset management arm of the HDFC Ltd (Promoter) and was established in 1999. In 2001, Standard Life Investments acquired 26 per cent stake in HDFC AMC. As on March 2018, it managed an AUM of Rs. 2,91,985 crore out of which 51 per cent was equity AUM.

But should you subscribe to HDFC AMC IPO?

NDTV.com here brings to you what top brokerages say on HDFC AMC IPO:

Emkay Global said that HDFC AMC has maintained its market leadership in equity AUM (15.8 per cent share) and retail AUM (13.7 per cent share). Healthy traction from individual investors ensures consistency and lower volatility in AUM growth, it added. HDFC AMC has been generating stable returns for the past several years with the least capital requirement, which in turn has resulted in best-in-class return on equity.

However, any adverse impact on inflows, both for equity as well as debt funds, may impact overall revenues as well as profitability of the company, Emkay Global said.

According to Angel Broking, HDFC AMC is the most profitable AMC among top five AMCs. For FY18, HDFC AMC had reported profit after tax/average assets under management of 0.26 per cent, whereas the other top five players had reported the same in the range of 0.21-0.14 per cent, the brokerage noted.

Angel Broking gave a 'subscribe' call to HDFC AMC IPO citing huge potential for mutual fund industry's growth, strong return ratios, asset light business, higher dividend payout ratio and track record of superior investment performance of the company.

HDFC AMC also has strong brand recall value among customers, which can be attributed, in part, to the strength of its brand and strong parentage, said HDFC Securities. With an individual investor focused strategy, HDFC AMC has a customer base with a greater proportion of individual AUM in comparison to the country's mutual fund industry.

However, if investment products underperform, HDFC AMC's AUM could decline and adversely affect the revenues, reputation and brand. Historical growth rates may not be indicative of future growth and if it does not manage growth effectively, its financial performance could be adversely affected, the brokerage said. If techniques for managing risk are ineffective, HDFC AMC may be exposed to material unanticipated losses

Gold Prices Plunge To 5-Month Low: 5 Things To Know

Gold Prices Plunge To 5-Month Low: 5 Things To Know

NEW DELHI:MMNN:18 July 2018

Gold prices on Wednesday tumbled by Rs. 250 to trade at over five-month low of Rs. 30,800 per 10 grams at the bullion market amid weakening global trend and considerable fall in demand from local jewellers, reported news agency Press Trust of India (PTI). Silver followed suit and dropped by Rs. 620 to Rs. 39,200 per kg on poor off take by industrial units and coin makers. Traders said sentiment was downbeat as gold prices slipped to their lowest in a year in global markets, as the dollar firmed after Federal Reserve Chairman Jerome Powell's US economic outlook reinforced views that the central bank is on track to steadily hike interest rates, eroding appeal of the precious metal.

Here are key things to know about gold and silver prices today:

1. Globally, spot gold was largely unchanged at $1,227.78 an ounce in early day trade. On Tuesday, it fell 1 per cent and hit its lowest since last July at $1,225.58 an ounce, reported news agency Reuters. US gold futures for August delivery were little changed at $1,227.80 an ounce.

Besides, muted demand from local jewellers and retailers at domestic spot markets too weighed on prices.

2. In Delhi, gold of 99.9 per cent and 99.5 per cent purity plunged by Rs. 250 each to Rs. 30,800 and Rs. 30,650 per 10 grams, respectively, a level last seen on February 8, 2018. The precious metal had lost Rs. 100 yesterday. Sovereign, however, remained unaltered at Rs. 24,700 per piece of eight grams.

3. Analysts expect the price of gold to dip to Rs. 29,500 per 10 grams this week.

"As far as mid-term trend in domestic gold prices is concerned, festive demand will start not before September. We may see a jump in physical demand for advance purchasing of jewellery in August since wedding season will kick-start post Diwali in November," says Gaurav Katariya, research head, commodities, Arihant Securities.

4. Following gold, silver ready dropped by Rs. 620 to Rs. 39,200 per kg and weekly-based delivery by Rs. 690 to Rs. 38,290 per kg.

5. Silver coins, on the other side, were unaltered at Rs. 74,000 for buying and Rs. 75,000 for selling of 100 pieces in scattered deals.

HUL Share Price Falls 4% Despite Strong Q1 Earnings

HUL Share Price Falls 4% Despite Strong Q1 Earnings

NEW DELHI:MMNN:17 July 2018

Shares in HUL or Hindustan Unilever fell nearly 4 per cent on Tuesday, a day after the FMCG major reported strong quarterly earnings. HUL shares opened nearly 1 per cent lower at Rs. 1,770 on the BSE, and dipped to as much as Rs. 1,685.05 at the day's lowest point. On the broader NSE, HUL shares fell 3.9 per cent to hit an intraday low of Rs. 1,683.25. At 1:00 pm, HUL shares were trading more than 3 per cent lower on both the bourses. HUL was also the top laggard on benchmark indices Sensex and Nifty.

HUL registered a 19 per cent year-on-year rise in net profit at Rs. 1,529 crore in the quarter ended June, according to a regulatory filing post-market hours on Monday. The company had reported a net profit of Rs. 1,283 crore for the corresponding period a year ago. Total sales grew 3 per cent to Rs. 9,356 crore during the quarter, compared with Rs. 9,094 crore in the year-ago period.

Analysts said the quarterly performance of HUL was in line with their estimates.

"HUL has been enjoying a favorable base along with market share gains in the last 4 quarters. However, the base will be higher in the coming quarters. This may lead to relatively slower growth performance… Input inflation is high but co has enough levers to pass-on to consumer," said HDFC Securities.

The brokerage sees limited upside in HUL shares from the current juncture. It recently downgraded HUL to 'neutral' with a target price of Rs. 1,709.

Going forward, brokerage Edelweiss expects HUL to be a key beneficiary of "an anticipated rural recovery and herbal push". Edelweiss recommends ‘hold’ with a revised target price of Rs. 1,887.

HUL shares traded with large volumes. By afternoon, nearly 2.2 lakh HUL shares had changed hands, compared with a two-week average of 64,000

US Plan On Work Permits For Spouses Of H-1B Visa Holders In Limbo

US Plan On Work Permits For Spouses Of H-1B Visa Holders In Limbo

NEW DELHI:MMNN:3 July 2018

The US has yet again missed the deadline to issue a notification on ending the H-4 visas, which are issued to spouses of H-1B visa holders, mostly held by highly-skilled Indian IT professionals. Earlier, the Department of Homeland Security (DHS) had informed a court that it was working to issue a Notice of Proposed Rule Making (NPRM) regarding H-4 visas in June this year. H-4 visas are essential for spouses of H-1B visa holders because they allow them to work. Former US President Barrack Obama, under a special order, had provided work authorization to spouses of H-1B visa holders under H-4 visa scheme.

Here are 10 latest updates on H-4 visas, issued to spouses of H-1B visa holders:

1) According to a report by news agency Press Trust of India (PTI), at the end of the month of June, the DHS did not give any explanation for not issuing the notice of proposed rulemaking (NPRM), which would have formally kicked off the process to terminate work authorization to spouses of H-1B visa holders.

2) "I have no updates to provide at this time," a DHS official told PTI, noting that he cannot speculate on when a decision would be made.

3) As recent as June, the DHS had insisted that there was no change in its plans to withdraw the Obama-era rule of providing authorization to certain categories of H-4 visa holders.

4) In February, the DHS had missed a similar deadline when it told a federal court, which was hearing a litigation, that it anticipated submitting to the Office of Management and Budget for review and clearance the proposed rule in time for publication in June 2018. (Also Read: US Announces 15,000 Additional Visas For Foreign Workers)

5) The United States district court of Columbia is hearing an ongoing petition by Save Jobs USA which has filed a lawsuit against the decision of the previous Obama administration to give work authorization to spouses of H-1B visa workers whose green card applications have been approved.

6) More than one lakh H-4 visa holders have been beneficiaries of the Obama-era rule.

7) The 2015 rule issued by the Obama administration allows work permits for spouses who otherwise could not be employed while H-1B visa holders seek permanent resident status - a process that can take a decade or longer.

8) The H-1B programme offers temporary US visas that allow companies to hire highly-skilled foreign professionals working in areas with shortages of qualified American workers.

9) Since taking office last January, the Trump administration has been talking about cracking down on the H-1B visa scheme.

10) During his election campaign, President Trump promised to increase oversight of H-1B and L-1 visa programmes to prevent their abuse. L-1 visa also allows for temporary transfer of foreign workers in the managerial, executive or specialized knowledge category to the US to continue employment with an office of the same employer.

Indian Entrepreneurs educated on Soy food Processing prospects

Indian Entrepreneurs educated on Soy food Processing prospects

NEW DELHI:MMNN:2 July 2018

Mumbai, 2nd July 2018 : In order to encourage soy food processing, Conference on the “Entrepreneurship Development in Soy Food Processing “ was held at Mumbai. This program was organised by the US Soybean Export Council (USSEC) jointly with the Association of Food Scientist and Technologists (AFST) and involving various stakeholders from the industry, government, academia, agri. Policy experts, US department of Agriculture (USDA), Food Safety and Standards Authority of India (FSSAI), Solvent Extractors Association of India (SEAI) and the financial institutions etc.

Mr. P Muthumaran, Director FSSAI for the Western and Southern Region was the chief guest on the occasion.

Speaking on the soy food business potential in India and the role soy can play in health and nutritional security of India, Dr. Ratan Sharma of the USSEC stated that Soybean is one of the very few plants those provide a high quality protein with minimum saturated fat. Soybean helps people feel better and live longer with an enhanced quality of life. Soybeans contain all the three macronutrients required for good nutrition, as well as fiber, vitamins, minerals. Soybean protein provides all the essential amino acids in the amounts needed for human health. Protein in just 250 grams of soy bean is equivalent to protein in 3 liters of milk or 1 kg of mutton or 24 no’s of eggs. In addition to being a rich source of nutrients, soybean has a number of phytochemicals (isoflavones), which offer health benefits along with soy protein. Soy protein and isoflavones together contribute to a number of health benefits such as, cancer prevention, cholesterol reduction, keeping heart healthy, combating osteoporosis and menopause regulation. Being low in glycaemic index soy plays a very important role in maintaining the low sugar levels in diabetics.

Dr. Sharma further explained about the nutritional quality of the soy oil from USA. Besides the regular nutritious soy oil US has developed high oleic soy oil. High oleic soy oil is being very popular as industry preferred substitute for partially hydrogenated vegetable oils and are used in all manners of processed foods especially the snack foods for deep frying. High oleic soy oil is free from trans fats as well as lower in saturated fat and contains three times more of beneficial monounsaturated fatty acid compared to conventional soy oil.

As per Dr. sharma US Food and Drug Administration FDA approved Bunge North America’s petition for a qualified health claim linking soybean oil consumption to reduced risk of heart disease. Soybean oil is the US’ most commonly used ingredient and top dietary source of polyunsaturated fats. Soy oil is the second largest edible oil used in India. Soybean oil is considered heart-healthy oil as it’s cholesterol-free and low in saturated fatty acids – it contains 61 % poly-unsaturated fatty acids. Two fat components essential for health and wellbeing, linoleic and linolenic acids, are also found in the right proportions in soybean oil. It is also a good source of vitamin E. Like fish oils, soybean oil contains omega-3, known to be protective against heart disease and cancer. He told that US soy oil is known for its nutritional superiority in comparison with the soy oils from other origins.

Discussing about the Soy food business opportunities in India Dr. Sharma very clearly mentioned that raw material plays a major role to produce a quality product delivering proper nutrients and making a tasty product. Food specialty soybeans are not grown in India limiting the growth of soy food sector in lack of desired quality product with limited value addition possibilities. Dr. Sharma highly recommended the food specialty soybeans from USA which produces an excellent quality soy food with much better acceptability of the end product and excellent value addition possibility when compare with the Indian soybeans.

Mr. Adam Branson the senior Agri. Attaché of Agriculture Affairs at the Foreign Agriculture Services, USDA of the United States Consulate general at Mumbai explained that a huge opportunity exists for the agriculture products trade between India and the United States. Adam stated that Agriculture is one of the top economies of the US and we look forward India as a great partner to us for the agri. business and the related trade. Adam further discussed about the bilateral trade relations between US and India, environmentally sustainable production of soybeans, about agri. commodities and other areas of US agriculture and agri. Products where both the countries can work together.