Farmers can now use old Rs 500 notes to buy seeds

NEW DELHI:MMNN:21 Nov. 2016

Days after allowing farmers to make cash withdrawals up to Rs 25,000 per week against sanctioned crop loans, the Centre on Monday announced that they will now be allowed to use old high denomination notes for purchasing seeds. Farmers can now use old Rs 500 notes at state-owned outlets towards the purchase of seeds, the Finance Ministry said in a statement.

With the onset of winter, farmers were gearing for the Rabi season. However, Prime Minister Narendra Modi’s November 8 announcement has taken a toll on rural population as the agriculture sector is entirely cash-dependent. Cash crunch meant that farmers had no money to pay farm hands, threatening production of key commodities. With food rations dwindling and no takers for old Rs 500 and Rs 1000 notes, daily-wage earners also struggled to make ends meet.

West Bengal Chief Minsiter Mamata Banerjee, who is trying to stitch up a rainbow coalition against demonetisation, asked the Centre to come up with a proper plan of action instead of “announcing new changes” everyday. “The lower middle class, traders, daily wagers, housewives are the worst sufferers,” she said.

Meanwhile, the Reserve Bank relaxed norms on cash withdrawals. It said that overdraft and cash credit account holders can now withdraw up to Rs 50,000 in a week. Earlier, current account holders were allowed to withdraw up to Rs 50,000 in cash, in a week. “On a review, it has been decided to extend this facility to Overdraft and Cash Credit accounts also,” the central bank said.

Accordingly, holders of current/overdraft/cash credit accounts, which are operational for the last three months or more, may now withdraw upto Rs 50,000 in cash, in a week.

However, this enhanced limit for weekly withdrawal is not applicable for personal overdraft accounts. The Reserve Bank further said the Rs 50,000 withdrawals may be disbursed predominantly in Rs 2,000 denomination bank notes.

Exchange of old notes over bank counters only up to Rs 2,000, just once till December 30

NEW DELHI:MMNN:19 Nov. 2016

The noose is getting tighter on those who are trying all possible means available to convert black money into white. The Reserve Bank of India on Friday announced that it will limit exchange of old notes into new ones at bank counters only once till December 30. The norm comes into effect starting Friday, November 18.

“On a review it has been decided that the limit of exchange of SBNs(Specified Bank Notes) in cash, across the counter of the banks shall be 2000 with effect from November 18, 2016. This facility will be available only once per person”, said the RBI in a note to the Chairman, Managing Director, Chief Executive Officer of all public, private banks, Regional Rural Banks, Urban and State Cooperative Banks.

However, there is no limit on making bank deposits.

In another development, Indian Bank Association said on Friday that banks will exchange the notes only for their own customers tomorrow( Saturday), i.e. people who have bank accounts with them. So, individuals will have to the banks where they have accounts to change the notes.

However, the banks will exempt senior citizens from this and exchange demonetised notes for them regardless of whether they have accounts with the banks or not.

Meanwhile, banks across the country will remain close on Sunday after they remained opened last weekend despite being holiday then.

The lending institutions will make use of Saturday to clear off the pending work.

Also, government has cautioned Jan Dhan account holders, housewives and artisans that they will be prosecuted under the I-T Act for allowing misuse of their bank accounts through deposit of black money in Rs 500/1,000 notes during the 50-day window till December 30.

The directive comes against the backdrop of reports that some are using other persons' bank accounts to convert their black money into new denomination notes. In some cases, even rewards are being given to account holders for allowing such misuse.

Big relief for farmers, agri-traders, families celebrating weddings

NEW DELHI:MMNN:17 Nov. 2016

With cash crunch following demonetisation + impacting agriculture sector, the government on Thursday announced a slew of measures aimed at smooth sowing season ahead, including permission to farmers to withdraw up to Rs 25,000 per week from their bank accounts.

This apart, for families that have an upcoming wedding, one member of the household can withdraw up to Rs 250,000 one-time, subject to furnishing an undertaking that no other individual will be availing such a concession for the purpose and also upon giving the PAN card details.

However, the amount of money that an individual can exchange from banks by handing over the old Rs 500 and Rs 1,000 notes has been lowered to Rs 2,000 from Rs 4,500+ with effect from Friday. The use of indelible ink for such withdrawals will continue.

Giving these details, economic affairs secretary Shaktikanta Das told reporters here that since the country is at the commencement of Rabi sowing season, the government wants to ensure farmers get smooth supply of inputs such as seeds and fertilisers.

"Crop loans are sanctioned by various bank to farmers. The government has allowed Rs 25,000 per week for farmers to draw in cash, subject to the limit of which crops they are sowing. This cash can also be taken from their Kisan credit card," Das said.

Another concession is for farmers who sell their produce through the various agricultural produce marketing committees.

"Farmers who sell their produce in mandis, against the payments they receive by way of cheque or RTGS method (electronic transfers into their bank accounts), they can draw up to Rs 25,000 per week from their own account," Das said.

Similarly, agri-traders registered with such marketing committees, can withdraw up to Rs 50,000 per week from their designated bank accounts.

Das said both Prime Minister Narendra Modi and Finance Minister Arun Jaitley decided to favourably consider the representations made by families that have upcoming weddings — hence the Rs 250,000 withdrawal allowance+ .

Two other decisions taken on Thursday are: A 15-day extension in the payment of crop insurance by farmers and an allowance for withdrawing Rs 10,000 as advance for central government employees up to Group 'C' to be adjusted against their November salary.

This will also apply to employees of Indian Railways, defence and state-run units.

SBI reportedly writes off bad loans of Rs 7,016 cr; Cong rakes up issue in Parliament

MMNN:16 Nov. 2016

The State Bank of India has cleaned up non-performing assets worth Rs 7,016 crore from its books by writing off loans given to 63 wilful defaulters, Daily News & Analysis reported on Wednesday. Of the 63 accounts, 31 have been partially written off and six shown as NPAs.

The clean-up drive saw the bank forgoing almost Rs 1,201 crore in dues to Vijay Mallya’s defunct Kingfisher Airlines, which is at the top of the list of wilful defaulters. In other words, loans given to Kinfsiher Airlines will no longer be shown in the bank’s balance sheet, though the airline has outstanding dues of almost Rs 1,201 crore. Some of the other prominent defaulters who feature in the write-off list are KS Oil (Rs 596 crore), Surya Pharmaceuticals (Rs 526 crore), GET Power (Rs 400 crore) and SAI Info System (Rs 376 crore).

The Congress party immediately reacted to the article and linked it to the government's demonetisation drive. "As Modiji's blue-eyed boy Mallya gets a Rs 1,200-cr write-off, fighting black money is political hypocrisy at its worst," said Congress leader Randeep Singh Surjewala.

Even Congress leader Anand Sharma expressed apprehensions that the money received from people migth be used to recapitalise the banks and wipe out Rs 6 lakh crore of non-performing assets of big industrialists.

"The Non-Performing Assets (NPAs) are to the tune of Rs 6 lakh crore. Do they want to utilise the money deposited by people in banks to wipe out the NPAs (on account) of industrialists who have played fraud on the country?" party spokesman Kapil Sibal said at a briefing by the All-India Congress Committee.

He claimed that the Reserve Bank of India RBI would transfer the money to the government, which would recapitalise banks and clear their balance sheets, and the "whole thing has nothing to do with black money; it is a compromise on black money and with NPAs".

Even Delhi Chief Minister Arvind Kejriwal has called demonetisation the biggest scam.

"This is what we feared. The hard-earned money of people will be put into banks to write off the loans of crorepatis. They have already started doing it," he said on Twitter."

Indelible ink to be used to identify people who exchange notes

MMNN:15 Nov. 2016

Even as the Opposition parties, including the Congress, Left, TMC, NCP and the JD(U), are to meet soon to formulate strategies in the coming winter session of Parliament to take on the government on the issue of demonetisation, Economic Affairs Secretary Shaktikanta Das, in a press meet on Tuesday, made a couple of announements to combat the crisis of cash crunch.

Mr. Das said indelible ink would be used at banks to identify people who exchange notes. He also announced the formation of a special task force to monitor the infusion of fake currency in to the market, especially in the vulnerable areas of the country. He pointed out that Prime Minister Narendra Modi reviewed the supply of currency for the second time in two days on Monday night.

Mr. Das urged places of worship, who receive smaller denomination notes, to deposit them in banks so supply of these notes increases.

He warned people not to fall prey to rumours being spread through social media.'We have enough stock of salts and there is no reason for a temporary surge in price or shortage. Supply of essential commodities is being closely monitored. There are a lot of stories spreading through social media, like reports of certain institutions going on strike. There is no such thing, please don't believe such reports.''

Mysore Paints asked to stock up on indelible ink

After providing indelible ink to the Election Commission since 1962 to mark voters, the Mysore Paints and Varnish Limited has a new task at hand. It has been asked by the government to keep its stocks ready so that the indelible ink can be used by banks to mark customers exchanging defunct currency notes to check suspicious deposits.

Prachanda asks Modi for help

Nepal Premier Prachanda called up Prime Minister Narendra Modi and sought an arrangement so that Nepalese holding a huge stock of banned high denomination Indian bank notes could swap them with legal currency in the country. Hundreds of thousands of Nepalese, who earn a living by working as daily-wage labourers in India, visit the neighbouring country seeking medical treatment or rely on Indian markets to purchase daily essentials, are said to be holding big chunk of scrapped Indian bank notes, Kathmandu Post reported.

Supreme Court refuses to stay govt. notification

The Supreme Court on Tuesday refused to stay the government’s notification demonetising Rs 500 and Rs 1,000 currency, but asked it to spell out the steps taken to minimise public inconvenience. “We will not be granting any stay,” a Bench comprising Chief Justice T. S. Thakur and Justice D. Y. Chandrachud said.

People throng ATMs, banks

As the day began, people began thronging ATMs and banks across the country to withdraw money and exchange Rs. 500 and Rs. 1,000 notes. Many banks had remained closed on Monday on account of Guru Nanak Jayanti.

The Congress and seven other Opposition parties met on Monday to formulate a joint strategy to put the government on the mat on the issue. After the meeting, Congress deputy leader in the Rajya Sabha Anand Sharma said, “There is broad consensus that the demonetisation issue should be raised in Parliament.”

Addressing a rally in eastern Uttar Pradesh’s Ghazipur on Monday, Prime Minister Narendra Modi targeted his opponents for criticising his move. He asked people if he should be frightened by powerful forces hurt by his decision, even as he reiterated he would face the consequences.

Micro ATMs to address cash crunch; Rs. 2,000 notes in ATMs in 2 days

NEW DELHI: MMNN:14 Nov. 2016

A day after Prime Minister Narendra chaired a meeting to review the demonetisation of Rs. 500 and Rs. 1,000 notes and its impact, Economic Affairs Secretary Shaktikanta Das on Monday announced that the now defunct currency would be accepted at government hospitals, petrol stations and toll booths till November 24.

The Prime Minister’s meeting came amid continuing chaos and growing public anger across the country over limited cash availability following the surprise demonetisation of the two higher value notes.

On Sunday, the cash withdrawal limit at ATMs was hiked to Rs. 2,500 from Rs. 2,000 a day.

The weekly limit of Rs 20,000 for withdrawal from bank counters was also increased to Rs. 24,000. The maximum limit of Rs. 10,000 a day on such withdrawals has been removed.

There's no dearth of money, but where is it and who has it? asks Modi

Our Correspondent Omar Rashid reports from Ghazipur where Mr. Modi held a rally. Describing his step as a strong decision, Mr. Modi compared it to a cup of strong tea people would ask him to make when he used to sell tea in childhood.

"I am used to making kadak chai [strong tea] since childhood. Poor people like kadak chai," he said. Here's the minute-by-minute coverage of the Prime Minister's address.

Shiv Sena says it is 'demonic and unsystematic'

Notwithstanding the Prime Minister’s emotional appeal to people to cooperate with him to weed out illegal money, the Shiv Sena on Monday described the demonetisation as “demonic and unsystematic” that has led to “financial anarchy” in the country. Instead of striking Pakistan, Mr. Modi has wounded Indian citizens who do not have any black money and the few who actually possess illegal funds have safely parked it in foreign banks.

Micro ATMs to be set up: Das

Mr. Das says the focus of the government is on activating all channels whereby cash is dispensed to the public. Banking correspondent will now be allowed to withdraw cash multiple times as opposed to only once a day earlier. "Banks to increase cash holding limit of banking correspondents to Rs 50,000. Micro ATMs will be set up across the country to tide over the cash crunch.

Clarifying on the recalibration of ATMs, he says a task force has been set up to address the issue at the earliest.The recalibrated ATMs will start dispensing Rs. 2,000 notes within two days.

Regarding the situation in post offices, he says the supply of cash to the 1.3 lakh branches will be enhanced. Also, those businesses with current accounts with banks can withdraw up to Rs 50,000 to pay wages to their employees.

To a question on the reasons for the delay, he explains that each ATM carries four trays and three of them carry Rs. 500, Rs. 1,000 notes. Those trays have to be replaced and recalibrated. And, only only one tray is being used right now.

"Please remember, it's a huge task. Even the Prime Minister said that there would be inconvenience. But the govt. is doing all it can and the situation is improving every day and every hour," he says.

Banks closed today; queues get longer at ATMs

Cash-strapped people were seen standing outside ATMs from early morning but had very little success as most of the machines were running dry. Scuffle and heated exchanges at ATMs were reported from many parts of the country.

Congress, TMC meet to plan united fight in Parliament

Congress and TMC leaders will discuss and chalk out a strategy to counter the Centre on the demonetisation issue during the Winter Session of Parliament.

Leader of the Opposition in the Rajya Sabha Ghulam Nabi Azad and his counterpart in the Lok Sabha Mallikarjun Kharge will meet TMC leader Sudip Bandyopadhyay, sources said.

U.P. Congress leader backs move

Our correspondent Smita Gupta reports that Congress leader Harikesh Bahadur has come out in support of the government's move to scrap the notes. Mr. Bahadur, on Monday, issued a statement saying,"The decision to ban Rs. 1000 / Rs. 500 currency notes is a correct and a necessary measure to restore financial discipline and regulate the economy. It will unearth black money and act as a deterrence on generation of black money. All citizens should prepare themselves to tolerate minor hardship for some time for development of the nation and prosperity of the people.(sic)" More...

Mamata calls up Yechury, but to no avail

A day after she urged all the Opposition parties, including the CPI(M), to unite against the demonetisation move, Bengal Chief Minister Mamata Banerjee said she called up President Pranab Mukherjee and CPI(M) general secretary Sitaram Yechury on Sunday.

“Ms. Banerjee made a frantic call to Mr. Yechury today [Sunday] afternoon when he was travelling. The Chief Minister urged him to unite against the centre. But Mr. Yechury said that he would only be able to take a call on the matter after discussing it within the party,” CPI(M) Polit Bureau member and MP Md. Salim told.

Banks say note exchange facility being misused

NEW DELHI: MMNN:12 Nov. 2016

Confusion over the facility for exchanging old high-denomination notes, subject to a limit of Rs 4,000, at banks and post offices by providing valid identity cards has led to some people misusing the system to legalise their unaccounted wealth.

At present, the exchange facility is a one-time window and the limit will be reviewed after November 24. Several bank officials told ET that the exchange of demonetised Rs 500 and Rs 1,000 notes over the counter for Rs 4,000 is being misused and banks are taking steps to address the issue.

A senior official with the State Bank of India said the Reserve Bank of India has sent an email to banks stating that the exchange facility for Rs 4,000 is a one-time window. “But we have no way to track whether an individual has already availed of this benefit at another bank,” he said.

“The intention is to support people to meet exigencies. The ATMs are now functional and people can withdraw money as per the existing limits,” said a senior official with Punjab National Bank, adding that some individuals are misusing this window by going to different branches of a bank or other banks.

People can also use multiple IDs at the same branch or post office as systems are not in place to verify transactions.

State-run Central Bank of India has developed software to keep track of the Aadhaar number and PAN card of beneficiaries, which is shared across all its branches, an official said.

“It is taking time to update, given the huge flow of people, but we are ensuring that the facility is made available only once and is not misused,” he said.

A senior official with Corporation Bank said that individual branches are maintaining a similar database and no person can exchange currency for more than Rs 4,000 at the same branch.

“We are educating people on the guidelines – some of them don’t know about it and are not coming with any mala fide intention,” he added.

A finance ministry official said all such data will be collated and tracked. “If there is any unusual pattern of withdrawals from any Aadhaar number and PAN account, we will be investigating such cases,” he said.

Specified bank notes of aggregate value of Rs 4,000 or below may be exchanged for any denomination of bank notes with a requisition slip in the format specified by the Reserve Bank and proof of identity, the RBI said in a circular dated November 8.

“The limit of Rs 4,000 for exchanging specified bank notes shall be reviewed after fifteen days from the date of commencement of this notification and appropriate orders may be issued, where necessary,” the RBI said.

Cash withdrawal from a bank account over the counter is restricted to Rs 10,000 a day, subject to a limit of Rs 20,000 a week, until November 24.

Withdrawal from ATMs is restricted to Rs 2,000 per day per card up to November 18.

New notes for old: Citizens rush to banks, post offices

BENGALURU: MMNN:11 Nov. 2016

Early Thursday morning, Bengalureans made a beeline for banks and post offices across the city to exchange the demonetized Rs 500 and Rs 1,000 notes for those of smaller value.

Scores of people had queued up in front Canara Bank, Yelahanka New Town branch in north Bengaluru by 7.30am, two hours before it opened. With banks and ATMs closed on Wednesday and Thursday, the liquidity crunch had hit the aam family hard.

Banks threw open their doors at the scheduled timing to unceasing questions and confusion. Quarrels and tears were a common sight as panicky citizens just wanted to get rid of their old notes. Amid tight security to ensure smooth handling of the public, queues snaked out of the branches on to roads, disrupting traffic flow. Those waiting at post offices had to return empty-handed as money had not yet reached.

"When else can I exchange them? Who will do it for me later on?" questioned Muthamma, 70, unwilling to believe officials at a public sector bank who tried explaining that she could exchange the money later.

Bank branches around Mysuru Road in southwest Bengaluru saw small shop owners and traders trooping in with every passing hour.Hard-pressed for space, security personnel had to hold the gates tight to keep out to the burgeoning crowds. "Senior citizens are not able to understand the procedure properly. They are afraid of keeping Rs 500 notes with them. No matter how many times we explain, they just don't understand," said an official at a public sector bank in the area.

Asked why those with accounts in the bank should also produce identity documents to deposit money, an HDFC Bank staffer at the RT Nagar branch tersely said: "Madam, today we are not HDFC Bank. We are RBI."

Request forms to initiate cash exchange began running out at most places, sending officials and citizens into distress. The forms that took less than a minute to fill became the most important document, without which citizens' identity proof would also be no good. At Canara Bank, Koramangala, citizens who realized they could exchange a maximum of Rs 4,000 at a time, launched into a series of discussions and deliberations.

At the General Post Office, however, there was excitement in the air when news broke that the Reserve Bank of India would be sending only new Rs 2,000 notes. "We may be the first to see them, perhaps," said Malathi Rao, waiting eagerly.

Many were waiting since morning for the consignment of notes, which arrived at 12.30pm under tight security. Mohammed Rafeeq, a resident of Shivajinagar who runs a fruit business, told, "I've been waiting since yesterday to get the notes exchanged.There's no food in my house since last night."

Thimmoji Rao, assistant chief post master, explained the delay to impatient citizens, "We couldn't have brought the currency from the RBI last night due to lack of security . It had to be done this morning."

Holding up her two crisp Rs 2,000 notes, Padmavathi M, a retired BSNL official, was the first at the GPO to successfully exchange her notes. "I was in the area to collect my pension and when I saw the line forming up at the GPO, I thought I should join as well. Anyway, it was worth it."

Post offices in Indiranagar and Koramangala saw an unbelievable turnout of citizens waiting to exchange their old notes. Said one official, "Look at this crowd, it seems like the world is going to end tomorrow and they have to get rid of the money as soon as possible."

A senior citizen, Thimmaraju Manjunath, waiting at the post office on Rajbhavan Road, told TOI: "You are from the press? Then make sure Mr Modi knows what we're going through."

Just across the road at the State Bank of Mysore branch, citizens got into a fiery argument over jumping queues.Some others demanded that women be given priority at the counters.

"We've all been waiting here since morning and even at noon, we haven't got to work," said Mona Kar, a private firm employee.

The main branch of Canara Bank (Town Hall) saw at least 200-300 people lined up to exchange their notes. "Not all gathered here need the money because of an emergency. They are paranoid about losing their cash, we are trying to explain to them to queue up only if it's an emergency. They have time till December 31 to exchange old notes."

Frazzled citizens outside Corporation Bank in Koramangala quarreled over queue breaking. "People are panicky and agitated. No one likes to stand in long queues but it isn't easy to handle so many notes and transport them safely. We must look at the larger picture and cooperate as it's just a matter of a few days till things normalize," said an official at the branch.

GATEWAYS TO BWSSB PAYMENT

BWSSB has made it easy for customers to pay their bills through online payment gateways like Paytm, Pay u, Citrus and BillDesk. This will be functional from November 18 to December 31 till the process of exchanging old notes is complete. BWSSB will also receive at its kiosks high denomination notes towards payment till Friday midnight. Consumers can visit BWSSB website http:www.bwssb.gov.in to pay online.

FUEL STATIONS SAY NO TO NEW NOTES

At a few petrol stations, attenders refused to take new notes from customers.A distraught Sanjay who stopped at a petrol bunk in Kamakshipalya was shocked that the attender didn't take the brand new Rs 2,000 note from him, though he had enough change to give Sanjay. "This is unfair. We first stand in line the whole day to get new notes and now they refuse to take it saying they can't accept them today.He isn't even clear what the problem is with Rs 2,000 notes," said Sanjay.

New Rs 500, Rs 2000 notes hit market

New Delhi: MMNN:10 Nov. 2016

As the banks reopened for the first time on Thursday since the demonetisation of Rs 500 and Rs 1000 notes on Tuesday night, many rushed to deposit/exchange old notes across the country. Here are 10 latest devlopments.

1. Long queues at banks to exchange old notes

Long queues were seen outside banks across the country and also at RBI counters for replacement of old Rs 500 and 1,000 notes on Thursday. Banks have made additional arrangements for exchanging cash and deposit of old high denomination notes in order to handle heavy rush. Banks have been asked to be open on weekends including Sunday to deal with the situation.

2. No harassment over small deposits under demonetisation: Jaitley

Finance minister Arun Jaitley on Thursday said nobody would be harrassed over smaller deposits — less than Rs 2.5 lakh — as people began thronging banks nationwide to exchange or deposit Rs 500 and 1,000 currency notes that have been demonetised. "Nobody will face questions or harassment for small deposits," Jaitley said.

3. Jaitley said people might face problems initially but in the medium to long run they will definitely benefit from the government's policy of demonitising large currency notes in a bid to curb corruption, unaccounted wealth and terror financing.

4. It is only those with large amounts of undisclosed money who will have to face the consequences under existing laws, Arun Jaitley said.

5. New Rs 1,000 notes with extra security features in a few months

Government will re-introduce Rs 1,000 bank notes in a few months and also issue new series of lower denomination bills with enhanced security features. "In a few months, Rs 1,000 notes with new features will be brought into the market," said economic affairs secretary Shaktikanta Das said.

6. New notes of all denominations with added security features

The currency notes of lower denomination of Rs 100 and Rs 50 will continue to be the legal tender, economic affairs secretary Shaktikanta Das said said, adding the Reserve Bank will come out with new series of such notes with new design and added security features. He said the RBI, time and again, has been introducing new series of currency notes with new design and enhanced security features.

7. Craze for selfie with Rs 2,000 note catches on

Posing with the new Rs 2,000 currency note is the latest trend to hit India, with people taking to social media with the freshly-minted notes. #Rs2000 is currently viral on Twitter, Instagram and Facebook along with photos and morphed selfies with RBI governor Urjit Patel.

8. Random checks by RBI officials

"Special squads of RBI officials are conducting random checks in the bank branches and keeping a tab on the developments," a senior official of Union Bank of India said.

9. Extra police deployment

Addition personnel of paramilitary and police along with quick reaction teams have been deployed across cities for maintaining security in banks in view of rush of people to exchange the now-invalid currency notes of Rs 500 and Rs 1,000

10. SC to hear plea against demonetization of notes on Tuesday

The Supreme Court on Thursday refused to grant an urgent hearing on a PIL challenging the Narendra Modi government's decision to demonetize high denomination notes of Rs 500 and Rs 1,000. Apprehending that the court may pass interim order on the issue, the Centre has filed caveat in the apex court which means that no order could be passed by court without hearing government contentions. The petition, filed by a lawyer, alleged that sufficient time frame had not been given for the transition and it would create unprecedented chaos and panic among people.

Rs. 500, Rs. 1000 notes no longer legal tender

New Delhi: MMNN:9 Nov. 2016

Currency of Rs. 500 and Rs.1,000 ceased to be legal tender from midnight on Tuesday. Prime Minister Narendra Modi announced this in a surprise address to the nation on Tuesday night. He said the decision was taken to root out the menace of black money and corruption.

Notes of Rs. 100, Rs. 50, Rs. 20, 10, Rs. 5, Rs. 2 and Re. 1 remain legal tender and will be unaffected by the decision, the Prime Minister said, adding that all banks and ATMs will be closed on Wednesday and ATMs in some places on Thursday as well.

Mr. Modi announced that the existing Rs. 500 or Rs. 1,000 notes can be deposited in an individual’s bank or post office accounts between November 10 and December 30. Currency value of up to Rs. 4,000 can be exchanged from any bank or post office a day till November 24 by showing a government identity card.

However, for 72 hours, government hospitals, railway, air and government bus ticket booking counters will continue to accept the old notes. Old notes will also be accepted till November 11 at petrol, diesel and gas stations authorised by public sector oil companies, consumer co-operative stores authorised by State or Central government, milk booths authorised by States as well as crematoriums.

The Reserve Bank of India will issue new Rs. 500 and Rs. 2,000 notes starting from November 10. The new Rs. 500 note will feature the Red Fort and the new Rs. 2,000 note will feature Mangalyaan, Economic Affairs Secretary Shaktikanta Das said at a media briefing late on Tuesday night. These notes will become available from November 10.

Once the ATMs start functioning, there will be a withdrawal limit of Rs. 2,000 per debit card, which will be increased to Rs. 4,000 later, Mr. Modi said in the 40-minute televised address to the nation. There will, however, be an overall limit on withdrawal from banks of Rs. 10,000 a day and Rs. 20,000 a week, which will be increased in the coming days.

Mr. Modi said there will be no restriction of any kind on non-cash payments by cheques, demand drafts, debit or credit cards and electronic fund transfer.

Without naming Pakistan, the Prime Minister made a pointed reference to cross-border terror that was being funded by forged currency notes. “In the country’s history of development, there comes a moment where powerful and decisive decisions are needed,” he said.

“Your money will be your money. You don’t have to worry about this. We have made arrangements to ensure that citizens suffer the least possible difficulty,” he said.

‘Surprise essential’

A government official said that the move was necessary to stop terrorists and drug cartels “in their tracks.” “An element of surprise is essential, or else they would have made necessary arrangements.” The official described the action as a “surgery since the tumour had to be removed to prevent recurrence.”

He claimed that this will result in a reduction of inflation as conspicuous consumption will come down. According to him, the “tumour of corruption could not be fought through tried, tested and failed methods” and it was time to employ new methods to defeat the enemies of India. Till March 2016, Rs. 14 lakh crore out of Rs. 16 lakh crore worth currency issued by the RBI were in the denominations of Rs. 500 and Rs. 1,000, as per the central bank’s official data.

Currency values circulated by Reserve Bank of India till March 2016

| Currency values |

in Rs. Billion |

| Rs. 2 and 5 |

45 |

| Rs. 10 |

320 |

| Rs. 20 |

98 |

| Rs. 50 |

194 |

| Rs. 100 |

1578 |

| Rs. 500 |

7854 |

| Rs. 1000 |

6326 |

| Total |

16, 415 |

India Firms to List 600 Million Pounds of Masala Bonds in London

New Delhi: MMNN:7 Nov. 2016

India is preparing to list about 600 million pounds ($746 million) of so-called masala bonds in London as it seeks to fund expansion of its energy and transport infrastructure.

Four bonds -- denominated in rupees, but sold overseas -- will be issued by the state-backed Indian Railway Finance Corp., Indian Renewable Energy Development Agency, Energy Efficiency Services Ltd. and National Highways Authority of India by the end of January, U.K. Prime Minister Theresa May’s office said on Monday in an e-mailed statement.

The announcement is a bright spot in May’s three-day visit to India, during which she’s already clashed with her counterpart, Narendra Modi, over British visas for Indian students. May is trying to show the U.K. is “open for business,” even as she prepares to extricate the country from its four-decade membership of the European Union.

Her office said the renewable energy and energy-efficiency bond issues also highlight London’s growth as a center for green financing.

“This is another vote of confidence in our world-leading financial services and further proof that Britain is open for business,” May said in the statement.

“This government will continue to work closely with both India and our financial services sector to ensure our growing rupee bond market continues to help finance India’s ambitious infrastructure investment plans.”

Punjab National Bank Q2 Net Profit Dips 11.5% To Rs. 549 Crore

New Delhi: MMNN:5 Nov. 2016

State-owned Punjab National Bank today reported a 11.5 per cent fall in net profit at Rs. 549.36 crore for the second quarter ended September 30 on rise in provisions for bad loans.

The bank had reported a net profit at Rs. 621.03 crore during the July-September quarter last fiscal.

"Total income increased to Rs. 14,218.27 crore for the quarter ended September 30, 2016 from Rs. 13,701.93 crore for the same quarter a year earlier," the bank said in a regulatory filing.

Total interest, however, earned by the bank in the three-month period fell by 4.16 per cent to Rs. 11,830.36 crore from Rs. 12,345.03 crore a year earlier.

During the quarter, provisions for bad loans increased 34.6 per cent to Rs. 2,533.76 crore from Rs. 1,882.08 crore in the year-ago period.

Gross NPAs as a proportion of total advances moved up 13.63 per cent during the second quarter as against 6.36 per cent in the corresponding period last fiscal. Net NPAs also rose 9.10 per cent as against 3.99 per cent in the quarter under review.

Shares of the bank closed at Rs. 131.60 apiece on the BSE on Friday.

UK's New Visa Crackdown To Impact Indian IT Professionals

London: MMNN:4 Nov. 2016

In a crackdown to curb its soaring immigration figures, the UK government has announced changes to its visa policy for non-EU nationals, which will affect a large number of Indians especially IT professionals.

Under the new visa rules announced last evening by the UK Home Office, anyone applying after November 24 under the Tier 2 intra-company transfer (ICT) category would be required to meet a higher salary threshold requirement of 30,000 pounds from the earlier 20,800 pounds.

The ICT route is largely used by Indian IT companies in Britain and the UK's Migration Advisory Committee (MAC) had found earlier this year that Indian IT workers accounted for nearly 90 per cent of visas issued under this route.

The changes come just days before British Prime Minister Theresa May lands in India on Sunday for her three-day visit.

"The first of two phases of changes to Tier 2, announced by the government in March following a review by the Independent Migration Advisory Committee, will affect applications made on or after November 24 unless stated otherwise," a UK Home Office statement said.

Besides the Tier 2 ICT salary threshold hike, the other changes announced include increasing the Tier 2 (General) salary threshold for experienced workers to 25,000 pounds, with some exemptions; reducing the Tier 2 (ICT) graduate trainee salary threshold to 23,000 pounds and increasing the number of places to 20 per company per year; and closing the Tier 2 (ICT) skills transfer sub-category.

A number of changes have also been announced for the Tier 4 category, which covers maintenance requirements for the Doctorate Extension Scheme.

Nationals outside the European Union, including Indians, will also be affected by new English language requirements when applying for settlement as a family member after two and a half years in the UK on a five-year route to residency settlement in the UK.

The new requirement will apply to partners and parents whose current leave to remain in the UK under the family immigration rules is due to expire on or after May 1, 2017.

The changes follow advice by the MAC earlier this year to curb the Tier 2 ICT route and reduce reliance on foreign workers.

"(Immigration) is not serving to increase the incentive to employers to train and upskill the UK workforce. Ready access to a pool of skilled IT professionals in India is an example of this," the MAC report had said in its findings.

"We did not see any substantive evidence of long-standing reciprocal arrangements whereby UK staff are given the opportunity to gain skills, training and experience from working in India," it noted.

The MAC had added that the evidence indicates that multinational companies with a presence in India had developed a competitive advantage in delivering IT projects in the UK.

"They have developed a delivery model, whereby significant elements of projects are delivered offshore in India, taking advantage of the fact that Indian salaries are lower than in the UK for equivalent workers.

"Indeed, partners told us that India currently has a competitive advantage in training IT workers and in the time it would take to fully upskill the native population, technology would have moved on," the report concluded.

The new rules follow further tightening of the Tier 2 category, which came into force in April this year.

"The UK government's reforms to Tier 2 work visas are intended to ensure that businesses are able to attract the skilled people they need, but also see that they get far better at recruiting and training UK workers first," then UK Immigration minister James Brokenshire had said.

Jindal Steel Again Defaults On Interest Payment

New Delhi:MMNN:3 Nov. 2016

Jindal Steel and Power Ltd on Thursday said it has failed to pay Rs. 15.43 crore interest on non convertible debentures (NCDs), which was due on October 31.

"The company has not made payment of Rs. 15.43 crore towards the interests due on NCDs, the due date for payment of which was October 31, 2016," JSPL said in a regulatory filing.

Last month, the firm had said it has defaulted on payment of interest on NCDs, due on September 30, 2016 on account of cash flow mismatches.

In the last few months, the Naveen Jindal led company has divested some of its assets to pare debt. JSPL has a net debt of around Rs. 46,000 crore.

In October, the company said it will sell its 24 MW wind power plant in Satara, Maharashtra to a subsidiary of India infrastructure Fund II for an undisclosed amount.

Similarly, in May this year, the firm inked an agreement with JSW Energy, a firm led by Naveen's brother Sajjan Jindal, to sell its 1,000 MW power plant, at Raigarh, Chhattisgarh.

According to the deal, JSW will pay at least Rs. 4,000 crore, excluding net current assets, and an additional Rs. 2,500 crore if JSPL's power plant secures a long term power purchase agreement.

Likewise, in March, JSPL announced that its subsidiary Jindal Power has entered into a definitive agreement to divest 4.12 per cent stake in Indian Energy Exchange for an undisclosed amount by month-end.

SBI Cuts Home Loan Rate To Lowest In 6 Years In Bonanza For Buyers

New Delhi:MMNN:2 Nov. 2016

In cheer for home buyers, State Bank of India (SBI) has cut interest rate by 0.15 per cent to a six-year low. The revised rates for new borrowers are effective from November 1, 2016, for loans up to Rs. 75 lakh.

For woman borrowers, SBI has brought down the interest rate to 9.10 per cent per annum from 9.25 per cent while for others to 9.15 per cent from 9.30 per cent.

This means that on a home loan of Rs. 50 lakh of 30 years, a home buyer can save Rs. 542 per month on EMIs.

This limited period festival offer is valid from November 1, 2016 to December 31, 2016, SBI said.

The rate cut comes in the wake of the SBI lowering its deposit rates last month.

SBI in a statement said its home loans are the "cheapest in the market" and provides an opportunity for both, new home buyers as well as those who wish to switch over their home loan to SBI to save on EMIs.

Analysts say that the SBI's rate cut could increase the competitive pressure on other lenders to bring down their interest rates.

Under a new lending rate regime effective from April 1 this year, banks price their lending rates based on marginal cost of lending rate (MCLR), which is closely linked to the actual deposit rates. For new borrowers, the MCLR is revised every month. In SBI's case, a customer is locked into the MCLR for a year if he/she avails the loan.

SBI's managing director Rajnish Kumar told NDTV Profit that the move will benefit a lot of people who are looking for affordable homes. The bank is seeing a lot of demand for housing loan below Rs. 1 crore, he added.

As part of the festive season offer, SBI has also waived processing fee on its approved projects and balance transfer of home loans.

Dhanteras 2016: Significance of investing in gold today, and 3 things to keep in mind while buying

New Delhi:MMNN:28 Oct. 2016

Dhanteras or Dhanatrayodashi is an important Hindu religious festival which is celebrated on the first day of the five-day Diwali festival. ‘Dhan’ means wealth and ‘teras’ means the thirteenth day of the moon cycle. This year, it falls on October 28.

Also known as the festival of wealth, Dhanteras is celebrated in the month of Karthik, on the thirteenth day of Karthik Krishna Paksh. Goddess Lakshmi is worshipped on this day, along with Dhanvantri — an avatar of Lord Vishnu. Some even worship Kuber, the Hindu god known as the treasurer of the world. In India, where gold is not just a metal but an emotion as well, it is only natural that we have specific days when it is considered auspicious to buy gold. People purchase gold, silver and other household utensils on this day because they believe doing so will bring prosperity and good luck for the family and business endeavours.

Why buy gold on Dhanteras?

According to Indian mythology, King Hima’s 16-year-old son was doomed to die by a snake-bite on the fourth day of his marriage. When his wife found out, she did not let anyone in the house sleep on the fourth night. She put all her ornaments and gold coins in a heap and sang melodious songs. When Yamaraj, the god of death, came in the form of a serpent, he was blinded by the shine of all the gold and sat dazed listening to the songs, thus, not killing the prince. This is said to be the reason why people continue to invest in gold and silver even today, to ward off evil and make way for blessings. People also light lamps to worship Yamaraj on Dhanteras.

Things to keep in mind while buying gold jewellery

It’s great to buy jewellery on an auspicious day, but it’s important to make sure you get the right deal as well.

1. Make sure you check for Hallmark: It is important you analyse the quality of the metal before investing in it, so that there’s no regret later. Try and go for gold jewellery with Hallmark. This certification helps authenticate the purity of the metal. It is the standard mark is seen in most gold. A hallmark mentions the jeweller’s identification mark, year of hallmarking, karat and the stamp of the Bureau of Indian Standards (BIS).

While many jewellery brands often mention ‘Karat’ in their advertisements, a lot of people don’t know what it actually means. Karat denotes the measure of gold’s purity. For example, 24 carat or 24K contains 100 per cent gold content. Since an ornament with 24K gold would mean pure gold, it is more expensive than 22K or 18K gold. Also note that gold is a soft metal and a pure gold jewellery will be more malleable because of its low density.

The BIS stamp is a certificate that assures the jewellery is made in accordance with the standards laid by the bureau, which is the national standards organisation of India. It also contains the hallmarking year of the jewellery. In addition to this, jewellers also carry their personal hallmark that includes the purity of the metal and the year of making.

2. Stay away from stone-studded jewellery: If you’re buying gold mainly as an investment, then keep away from from those studded with stones, especially semi-precious ones. Though they may look much more attractive, remember that while buying, the stone is weighed along with the gold, so the ornament is priced accordingly. This weight is subtracted if you intend to sell the piece later. Stone jewellery also entails higher making charges.

3. Check for buy-back offers: Many jewellers have buy-back offers, wherein if you sell your jewellery back to the same store, then they will take the weight of the piece when bought into consideration, giving you a much better valuation of your ornament instead of going to another jeweller, who will first check the purity of the piece (here the Hallmarking helps, though) and deduct making charges as well.

Of course, if you don’t want to take a chance, you could always invest in gold ETFs.

Cyrus Mistry's hostile defence takes boardroom battle public

MMNN:27 Oct. 2016

Days after he was ejected as chairman of Tata Sons, Cyrus Mistry has stunned India with a hostile 5-page letter outlining governance failures, poor decisions and looming writedowns at one of the country's most revered conglomerates.

Mistry's emailed parting shot, leaked late on Wednesday, turned into a viral sensation in India by Thursday morning, captivating readers on social media and prompting shocked headlines in leading dailies, as the government told politicians to stay out of what has become a public spat.

The country's two largest exchanges, citing the leaks, have demanded clarity from Tata's 27 listed units.

At least one unit, Tata Steel, dismissed talk of writedowns. But shares in all of the group's major listed companies fell on Thursday.

Tata Sons has not commented since the letter, a defence of Mistry's record, surfaced.

"Mistry tears into Tata," the Times of India daily said.

Public confrontations of this nature are rare in Indian corporate life, particularly when they involve conservative and established conglomerates like salt-to-cars group Tata and a patriarch like Ratan Tata, who has temporarily taken back the helm of the parent group.

"It has taken everyone by surprise. Nobody would have thought such things could happen at Tata," said JN Gupta, a former executive at India's markets regulator and now managing director at Stakeholders Empowerment Services.

Inside Tata, a company that promotes its roots in the heritage and social values of the Parsi community, some workers have bristled at the board's treatment of Mistry: the company is famous for being a loyal employer. But executives also questioned Mistry's efforts to cut back or sell underperforming assets.

Ratan Tata was an acquirer in his time at the top: he oversaw deals like the $12 billion acquisition of Corus, formerly British Steel, in 2007 and the purchase of Jaguar Land Rover a year later.

Mistry by contrast, has tried to rationalise the sprawling portfolio, including selling much of the Corus business in Britain.

"It is like a bunch of finance or hedge fund guys that have walked in and decided to cut everything. This is not the Tata way of doing business," said one source close to the Tata group in response to the letter.

"If you are picking things that are not working and then trying to get rid of them, where is growth going to come from?"

BITTER FRUIT

Lawyers, analysts and headhunters said on Thursday that the letter could mark the start of a bitter legal battle - but it was already a warning to any willing candidates on challenges ahead in running a sprawling and complex group.

"Any candidate that is now in the race or is considered, will pull up and refer to the letter from Cyrus Mistry," said Suresh Raina, managing partner with Hunt Partners, an executive search firm. "The new candidate will be very well primed."

Mistry, chairman of Tata Sons since 2012, accused the board of failing to give him "room to move", and argued Ratan Tata acted as an alternative power centre after officially handing over the reins, driving in particular deals that created two airline businesses.

Its Tata Motors arm extended credit too easily to fuel sales, Mistry said, and when fraudulent dealings surfaced at AirAsia India, they were not acted on fast enough.

Ratan Tata's lawyer Abhishek Manu Singhvi, dismissed the accusations in comments to local television and questioned the purpose of the "blame game"

At least some investors brushed off the letter, arguing they too knew the extent of the balance sheet strain - but also Tata's record for keeping its companies afloat.

"The main question to ask is whether this letter means that Tatas will now change their style of business and will start closing down their loss-making units abruptly," said one debt investor who declined to be named.

"I will continue to buy Tata debt papers until I see some signs they are changing their style of business."

Yet governance experts said Tata would need to tackle the allegations, for which Mistry provides no proof.

"Either Tata comes out and denounces them successfully or they will lose their reputation as one of the best governed companies in the country," Gupta said.

India Ranks 13th In Protection Of Minority Investors

New Delhi:MMNN:26 Oct. 2016

India's global ranking in terms of protection of minority investors has slipped three notches to 13th, but remains much higher than the country's overall 130th rank for ease of doing business.

The sub-ranking for protection of minority investors is topped jointly by New Zealand and Singapore.

Others that ranked higher than India are Hong Kong, Malaysia, Kazakhstan, the UK, Georgia, Canada, Norway, the UAE, Slovenia and Israel.

In the World Bank's latest 'Doing Business' report, India's place remained unchanged from last year's original ranking of 130 among the 190 economies that were assessed on various parameters. However, the last year's ranking has been now revised to 131 from which the country has improved its place by one spot.

The list of countries in the Doing Business 2017 is topped by New Zealand while Singapore is ranked second.

The report said protection of minority investors indicator measures the protection of shareholders against directors' misuse of corporate assets for personal gain and the rights and role of shareholders in corporate governance.

According to the report, India carried out an ambitious, multi-year overhaul of its Companies Act, bringing Indian firms in line with global standards, particularly in respect of accountability and corporate governance practices while ensuring businesses contribute more to shared prosperity through a quantified and legislated corporate social responsibility requirement.

Company regulation is an ongoing process. Since the enactment of the Companies Act, 2013, the corporate affairs ministry issued notifications on a regular basis to address ambiguities in the law. Most notably, two sets of amendments were released in August 2014 and May 2015, highlighting the government's ongoing commitment to reform.

Further, in June last year, it set up a committee tasked with identifying further amendments to the Act and centralising recommendations and concerns from private sector stakeholders and regulatory agencies.

"Despite this piecemeal introduction, it has paid off both in economic terms and in India's performance in Doing Business. India's score increased in 3 of 6 indices of the protecting minority investors indicator set," the report said.

To simplify administrative requirements, the minimum paid-in capital was abolished. To instil greater transparency, the Act increased disclosure requirements, particularly regarding related-party transactions.

To bring Indian firms in line with global standards, the Act added requirements to disclose managerial compensation and have one-third independent directors and at least one woman on the board. Besides, India became the first economy in the world with a quantified and legislated corporate social responsibility (CSR) requirement.

"The case of India serves as a reminder of the time it takes and the challenges inherent to a holistic legislative overhaul. Piecemeal fixes can be a time and cost-effective approach, but only a full-fledged legislative reform gives policymakers the opportunity to innovate and sends a strong signal to the business community," the report noted.

Cyrus Mistry ouster: Tata Trusts has powers to remove Tata Sons chairman

Mumbai:MMNN:25 Oct. 2016

A day after Cyrus Mistry’s ouster as chairman of Tata Sons Ltd, there is a lot of speculation around the boardroom coup, but many of them don’t seem to be grounded in facts.

Separately, a reading of Tata Sons’s articles of association shows that Tata Trusts, its largest shareholder, gave itself special powers in nominating, approving and removing chairmen of Tata Sons in late 2012 – months before Mistry took over the top job in December that year.

For instance, media reports have said there were conflict of interest concerns raised about the award of contracts to companies belonging to the Shapoorji Pallonji Group after Mistry took over.

However, a person close to Mistry said that three years earlier (on 30 October 2013), Mistry had written to Tata group companies that no contracts were to be awarded to the Shapoorji Pallonji Group, run by his family.

Mint couldn’t independently ascertain the veracity of this claim and hasn’t seen a copy of this letter.

Calls made and messages sent to a Tata Sons spokesperson weren’t answered.

Shapoorji Pallonji group companies have had a history of working for the Tatas – even before Mistry’s appointment. For instance, Sterling and Wilson Pvt. Ltd, a part of the group, had (or is in the process) of executing at least seven projects for companies such as Tata Motors Ltd and Tata Power Co. Ltd, according to its web site.

Secondly, there are reports which say that Mistry had cleared the acquisition of Welspun India Ltd’s renewable energy assets without seeking approval from either Tata or other key shareholders.

“All legal and fiduciary requirements with respect to the Welspun acquisition were met as far as shareholders are concerned,” said the person close to Mistry mentioned earlier.

Typically, in a merger and acquisition deal, the board first takes the decision for the deal which is then put up for approval of shareholders.

In any case, giving prior information to a certain set of shareholders, even if they are promoters, would violate the listing obligation and disclosure regulations of the Securities and Exchange Board of India (Sebi).

“Any kind of selective disclosure is prohibited,” said JN Gupta, co-founder & managing director of Stakeholders Empowerment Services, a proxy advisory firm.

Another concern raised over Mistry’s functioning was that he didn’t present a five-year strategy plan to Tata Sons’s board. However, the first person quoted earlier said that the five-year plan was presented at least two months back. Mint couldn’t independently verify this.

On Monday evening, Tata Sons said the board had replaced Mistry as chairman and that Ratan Tata, his predecessor, would be interim chairman. A selection committee including Tata was mandated to find a replacement for Mistry in four months.

Still, while reasons for Mistry’s abrupt removal remain unclear, there is no doubt that the board of Tata Sons has the power to do so. Tata Trusts, which consists of a clutch of trusts such as the Sir Dorabji Tata Trust and the Sir Ratan Tata Trust, owns two-thirds of Tata Sons, and has special rights in the holding company of the conglomerate, especially when it comes to appointment and removal of chairmen, according to the Tata Sons articles of association.

According to article 104B, as long as Tata Trusts has at least 40% shareholding, it can nominate one-third of the directors of the Tata Sons board.

The quorum for a meeting of the Tata Sons board “shall include a majority of the directors who are appointed pursuant to Article 104B.”

The Articles also say that the selection committee will consist of three people “nominated jointly by the Sir Dorabji Tata Trust and the Sir Ratan Tata Trust who may or may not be directors of the company”, one person nominated by and among the board of directors and an independent outsider selected by the board.

More importantly, a majority of the directors nominated by the Trusts have to approve with affirmative voting the appointment and removal of chairmen. Affirmative vote items are those where, in the absence of participation by the concerned directors, the company cannot undertake an action.

Some of these special powers seem to have been added to the articles of association at the time of Mistry’s appointment as chairman and after that. To be sure, these may have also been added to protect the interests of Tata Trusts. Mistry’s appointment as chairman of Tata Sons was only the second time the trusts and the holding company had different chairmen. The first instance was when JRD Tata was the chairman of the Tata Trusts and Ratan Tata was chairman of Tata Sons for a few years in the 1990s.

The article relating to the selection process of chairman and the constitution of the selection committee was added by a special resolution passed at an extraordinary general meeting (EGM) held on 6 December 2012. The article relating to affirmative votes of a majority of directors nominated by the Trusts was passed at an EGM on 9 April 2014.

Perhaps, because of these, a prominent Mumbai-based corporate lawyer said, on condition of anonymity that it wouldn’t be advisable for Mistry to take the legal route.

An official spokesperson for the Shapoorji Pallonji group said in a statement: “Neither the SP Group nor Mr.Cyrus Mistry have made any statement yet. While the circumstances are being studied, there is no basis to media speculation about litigation at this stage. As and when a public statement becomes necessary, it would be made.”

While the boardroom putsch has been brewing for some time, Mistry himself is said to have been unaware of this impending removal. According to the person quoted earlier, Mistry, who had returned from China on Saturday from a business meeting, was informed about this just prior to the board meeting by Tata Sons director Nitin Nohria.

A second person close to Mistry said there has been lapses on both sides but nothing to warrant Monday’s action. He declined to elaborate.

A former Tata group executive told Mint that Mistry was an “aloof figure and chose to operate through the group executive council and his dealings with many of the CEOs were very peremptory and authoritative”.

On Tuesday, Ratan Tata met with CEOs of the operating companies of the Tata group, a move questioned by proxy advisors. That is because even though Ratan Tata is the interim chairman of Tata Sons, he automatically doesn’t become chairman of companies such as Tata Motors and Tata Power.

“Can a holding company call a meeting of group CEOs? I would say no. It is more of a custom and it is not correct,” said SES’s Gupta.

In a letter addressed to “colleagues” on Monday, Ratan Tata said that he agreed to take over as interim chairman “in the interest of and reassurance to the Tata group.” He reiterated that in the meeting with managing directors and senior leaders of Tata companies, a Tata Sons statement said.

“This will be for a short time. A new permanent leadership will be in place,” the statement quoted him as saying. Tata asked group companies to act as leaders in their respective markets and enhance returns to shareholders.

“I look forward to working with you as we have worked together in the past. An institution must exceed the people who lead it. I am proud of all of you, and let us continue to build the group together,” he was quoted as saying. He asked the leadership of the companies to focus on their respective businesses, without being concerned about change in leadership, according to the statement.

Referring to ongoing initiatives in the companies, he was quoted as saying, “We will evaluate and continue to undertake those that are required to. If there is any change, they will be discussed with you.”

The meeting lasted 25 minutes, Bloomberg reported, adding that Tata didn’t disclose reasons for replacing Mistry. The report cited a person with direct knowledge of the matter as the source for the information. Mistry’s replacement was announced on Monday after the close of stock-market trading.

In intra-day trading, shares of Tata Group companies fell on Tuesday. Tata Steel Ltd fell 4%, Tata Global Beverages Ltd declined 3.3%, Tata Power Co Ltd slipped 2%, Tata Consultancy Services Ltd shed 1.2% and Tata Motors Ltd was down 2.2%. The benchmark Sensex index was down 0.1%.

“The biggest issue is that this (Mistry’s ouster) is very sudden and immediate. Stakeholders would want to know the reason for this sudden and immediate change,” said Gupta.

Investment proposals worth Rs 5.50 lakh crore received at GIS 2016, claims Madhya Pradesh CM

Indore:MMNN:24 Oct. 2016

Madhya Pradesh Chief Minister Shivraj Singh Chouhan announced on Sunday that a total of 2628 proposals or 'Intention to Invest' were received by the state government during the 5th Global Investors Summit (GIS) held at Indore on October 22 and 23.

"We had decided against signing MoUs at the meet and instead had Intentions to Invest so that we can follow up on the proposals in a systematic way," he said, adding that the intentions add up to a total of Rs 5,46,847 crore. Also, 30 online applications for allotment of land from the nearly 1,25,000 acre land bank for industries being offered by the MP government were received during the GIS 2016.

MADHYA PRADESH GOVT TO START PORTAL CALLED 'INVEST'

Addressing the media after the conclusion of the GIS 2016, the CM said that based on the feedback given by delegates during the GIS, the state government has decided to start a portal called 'INVEST' that would contain all details of the proposal for investment submitted by a business group. He said this would help in effective and time bound monitoring. Besides this, the state government would appoint a 'relationship manager' for every investment more than Rs 50 crore.

The manager would give feedback to the investor on the status of the investment proposal. Based on feedback, the CM also said that a Ready Made Garment Policy would be soon unveiled by the state government to promote the sector. Land use rules would be simplified to promote investment, especially in the Public Semi Public (PSP) category in which colleges and institutions are set up. He said time bound clearance of land use change cases would be ensured.

Rules pertaining to transfer of development rights would be simplified and the process of securing a clearance from the pollution control board would also be made simpler. Also, the list of non polluting industries where pollution clearance is not requires would be further expanded. The rebates given to various businesses in commercial taxes would continue even after the imposition of GST, said the CM.

Further, the CM said, based on the discussions with investors, information pertaining to the availability of minerals in the state would be made available and the minimum number of seats in theatres to qualify as multiplexes and thereby get rebates would be reduced to 200 from the present 500. The CM said that to prevent harassment and treatment as criminals of investors, the state government will work out a system that will prevent arrest in case it is found that the violation of a commercial law was not deliberate.

INDUSTRIAL, AGRICULTURE SECTOR WITNESSES GROWTH

The CM said that in the intervening 2 years between GIS 2014 and 2016, work has commenced on investments worth Rs 2,71,000 crore and production has commenced in units that have invested about Rs 50,000 crore. He said the GDP of MP has increased from Rs 1,50,000 crore to Rs 5,65,000 crore in the last 12 years. Industrial sector has grown at 8 per cent while agriculture is growing at 20 per cent in the state in 2014-2015.

Earlier during a valedictory function, External Affairs Minister Sushma Swaraj, Urban Development Minister Venkaiah Naidu, Minister for Environment and Forests, Anil Dave, Petroleum Minister Dharmendra Pradhan and Minister for Social Justice Thawarchand Gehlot appealed to investors to put in their money and faith in Madhya Pradesh and praised the CM and government for organizing the event. Sushma Swaraj said that for the first time the MEA has a separate desk for facilitating states with investment proposals from overseas.

The CM said that he was happy with the progress of industrial sector in MP and added that the first GIS in 2007 was attended by 300 delegates while GIS 2016 was attended by a total of about 5000 delegates from India and 42 countries attended the GIS 2016. "this is an indicator that MP is doing well," he said. He said that for the first time the Department of Industrial Planning and Policy of the Union government had organized a 'Make in India' convention on the sidelines of an investor meet organized by a state government.

A CEO conclave attended by about 130 CEOs was held on October 21. A total of 326 Business to Business meetings were also held during the GIS 2016.

MP Global Investor Summit kicks off, 150 CEOs may participate

Indore:MMNN:22 Oct. 2016

A 2-day Global Investor Summit organised by the state government of Madhya Pradesh at its commercial capital Indore kick-started today. the state expects to host about 150 CEOs and over 3,000 delegates including the Union Finance Minister at the event.

While the state itself plans to invest Rs 75,000 crore over the next 4 years in infrastructure development, the Summit aims to garner as much investments from the business community across the world as possible in some key areas like food and food processing, and automobiles among others.

Some of the key speakers at the event, Baba Ramdev of Patanjali, Kumar Mangalam Birla, Chairman of Aditya Birla Group, Anil Ambani, Chairman of ADAG and Alok Sharma, UK's Minister for Asia among others listed out their investment plans in the state.

Located in the centre of the country, Madhya Pradesh will become a supply hub for companies transporting goods once the Goods and Services Tax (GST) is implemented making the country one big marketplace, Finance Minister Arun Jaitley said on Saturday.

Addressing the 5th Madhya Pradesh Investment Summit in Indore, Jaitley said the GST will hopefully be implemented by next year which will make the country one big marketplace.

“Once the GST rolls out, hopefully by next year, India will become one big market. Companies transporting goods from north to south and east to west will need a hub at the centre,” Jaitley said on the first day of the two-day summit that aims to attract global investment.

“Madhya Pradesh is suitable located to become a supply hub,” he added.

At the summit, the state government will present a report card on the status of investment commitments made at the four previous such investor gatherings.

In the 2007 summit, MP signed investment agreements worth $18.3 billion and the investment commitment doubled to $36 billion at the next summit in 2010 and further to $44 billion in 2012. The last meeting in 2014 saw signing of agreements worth $66.1 billion.

Madhya Pradesh has been one of the fastest growing states in India, recording an average annual growth of 9.5 per cent in its gross state domestic product (GSDP) from 2013 to 2015. The growth rate in 2015-16, was 10.5 per cent against the national growth of 7.3 per cent.

Over 3,000 delegates including 500 from five partner countries—the UK, Japan, South Korea, Singapore and United Arab Emirates—are attending this year’s summit.

Debit Card Breach Could Dent PM Modi's Push To Go Cashless: Foreign Media

MMNN:21 Oct. 2016

India's quest to become a cashless economy has been dealt a blow by a data breach that compromised as many as 3.2 million debit cards.

Prime Minister Narendra Modi urged Indians in a radio address in May to use cashless payments to discourage corruption and keep track of money. Convincing them may get harder after India's national card payments network said that the data violation led to fraudulent transactions, mainly in China and the U.S.

The illegal withdrawals were limited to 641 customers of 19 banks, and the total amount involved was just 13 million rupees ($194,000), the National Payments Corp. of India said in a statement late Thursday. Yet the breach could reduce faith for cashless transactions in a country where Google Inc. estimates the digital payments industry will grow 10 times to $500 billion by 2020.

"Given that most Indians are in the villages and not tech savvy, there will be lot of apprehension regarding usage of digital money and cards after this breach," said VVSSB Shankar, founder of i-lend, India's first peer-to-peer lender. "This is a major setback for India's fight against the cash economy. Banks will have to increase security measures and improve efforts to educate people to tide over this."

Cash King

The South Asian nation has been aggressively pushing cashless payments, touting its so-called JAM mechanism that involves bank accounts for the poor, biometric identity cards and high mobile phone usage. About 98 percent of consumer payments are still made with cash, a report by PricewaterhouseCoopers Plc showed in 2015. That's even with 697 million debit cards and 26 million credit cards in the country at the end of July, RBI data show.

Customers needn't panic, A.P. Hota, managing director and chief executive officer of National Payments, said in the statement. Banks have advised customers to change their card security codes, and in cases where customers couldn't be contacted, have blocked their cards and are issuing new ones, the payments system operator said.

State Bank of India, the nation's largest lender, said in a statement that it had blocked the cards of certain customers as a precautionary measure. ICICI Bank Ltd. said it had changed codes of cards used at affected ATMs.

Defense Lines

"Banks have taken steps to isolate affected cards and accounts," said Tirthankar Patnaik, Mumbai-based chief strategist and head of research at Mizuho Bank Ltd. "Also, in India, the bank customer has two lines of defense: a mandatory shadow reversal in case the customer notifies the bank of a breach and deposit insurance in case of an irreversible loss."

The Reserve Bank of India August blamed an "unusually high and protracted" demand for notes and coins for slowing down the velocity of money, or the pace at which commercial lenders make fresh loans, which in turn become new deposits for the banking system and lead to further credit expansion.

Currency in circulation is more than nine times what it was 17 years ago. By comparison, China's yuan pile has increased less than sixfold, even though the mainland's economic expansion has outpaced India's.

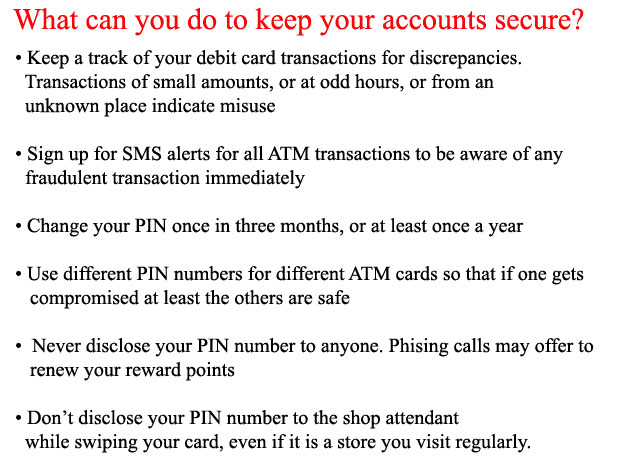

Post SBI security scare: Here is how you can secure your debit cards

Mumbai :MMNN:20 Oct. 2016

Days after the State Bank of India (SBI) blocked 6,00,000 debit cards over reports of security breach, clouds of suspicion hover above the heads of customers who fear falling prey to financial fraud.

"Card network companies like the NPCI, Mastercard and Visa had informed various banks in India about a potential risk to some cards owing to a data breach. Accordingly, State Bank of India (SBI) has taken precautionary measures and blocked cards of certain customers identified by the networks,"said a company statement on Thursday.

The SBI has asked its customers to use its fraud perevention facilities, adding that it was in the process of issuing new cards to its customers at no cost.

"Cardholders can generate the PIN through an SMS or by using the bank'sinteractive voice response system and internet banking. Alternatively, they can collect the PIN phycially from their home branch,"said the statement further.

According to SBI, customers can further choose their channel of transaction- ATM , PoS or eCommerce- and restrict their usage within domestic borders and beyond in order to ensure secure transactions. They can also set a card limit on their own by using the bank's internet banking service.

However, a series of measures can be taken to guard oneself against data theft and financial misuse.

Changing the ATM pin frequently is one way of keeping one's coffers safe. How often should you change your ATM PIN? The answer is-every three to six months or at least once a year according to the standard advice given by cyber experts.

One might ask as to why the banks are being overly cautious? Well, considering the reports of breach of data by financial institutions in the last few months, the threat of a security breach seems all too real to diregard for the customers.

Even Axis Bank had recently informed the Reserve Bank of India that it had experienced a cyber attack.

Reports of from several account holders complaining of their ATM card details being compromised have also surfaced, following which several banks have asked their customers to change their card security details and stick to their own ATM networks. According to reports, the overall number seems to be 3.2 million so far.And, perhaps, still counting.

According to Reshmi Khurana, Managing Director and Country Head-Operations for Kroll Advisory Solutions in India, there have been reports of customers reporting transactions on their debit cards in China and that is how banks came to know of the breach of data and in turn complained to payment services.

“While it is not confirmed, the breach of data seems to on account of a malware inserted in a white label ATM network, which is why banks are cautioning their customers to stick to their own bank’s ATM network and not use non-bank ATMs,’’ said Khurana.

An ATM breach means that PIN numbers of all customers using a partilcuar ATM network, that is infected, stands compromised.

Hence, it is advisable that one changes the PIN number as soon as one gets an alert from their respective bank. If possible, cancel the ATM card and apply for a new one.

Also, avoid using the same PIN for multiple bank accounts. Besides, signing up for SMS alerts from the bank is really helpful as it swiftly prompts a meassage once a transaction gets carried through. This way even if there is fraud, at least you will come to know of it immediately and alert your bank to block your card to prevent further loss.

For most customers, using the card at an ATM would seem like a safe transaction since the ATM is monitored by the bank. But it is not always the case. For instance, about 70 per cent of ATMs in India are running on outdated Operating Systems (OS), which makes it easier to make fraudulent transactions.

“Microsoft has withdrawn all support to Windows XP about two years back. But there are still many ATMs running on Windows XP OS, which makes them vulnerable to malware and frauds,’’ points out Harshil Doshi, Strategic Security Solutions Consultant, Forcepoint, a data privacy and security company.

Most banks also use ATM machines of different vendors due to which standardization of networks and technology is not possible. This too opens up the system to possible fraud, Doshi adds. Fraudsters have developed devices to infect all kinds of ATMs.

“Once the malware is deducted, the bank or the payment services company will fix it immediately. But the problem is to identify the malware. While such incidents are common overseas, now they are increasingly happening in India too as banks adopt more technology and transactions become digital. There is a need to be more proactive and put the proper checks in place,’’ Khurana adds.

Rooftop solar power capacity crosses 1 GW mark

New Delhi :MMNN:19 Oct. 2016